Chapter 14 — Presentation

Chapter 14 — Presentation

14.1 Overview

Concerns about the lease presentation requirements in ASC 840, particularly

those for lessees, provided the impetus for the

issuance of ASC 842. Specifically, in developing

ASC 842, the FASB decided to remove the

classification disparity between operating leases

and capital leases, bring all leases onto the

balance sheet, and require lessees to recognize

lease assets and lease liabilities in the

statement of financial position. As indicated in

the summary portion of ASU 2016-02, the primary

objective of the new presentation requirements is

to increase financial statement transparency and

give users a more “complete and understandable

picture of an entity’s leasing activities.”

Below is a more detailed discussion of ASC 842’s financial statement presentation requirements for both lessees and lessors.

14.2 Lessee

14.2.1 Statement of Financial Position

ASC 842-20

Statement of Financial Position

45-1 A lessee shall either present in the statement of financial position or disclose in the notes all of the following:

- Finance lease right-of-use assets and operating lease right-of-use assets separately from each other and from other assets

- Finance lease liabilities and operating lease liabilities separately from each other and from other liabilities. . . .

45-2 If a lessee does not present finance lease and operating lease right-of-use assets and lease liabilities separately in the statement of financial position, the lessee shall disclose which line items in the statement of financial position include those right-of-use assets and lease liabilities.

45-3 In the statement of financial position, a lessee is prohibited from presenting both of the following:

- Finance lease right-of-use assets in the same line item as operating lease right-of-use assets

- Finance lease liabilities in the same line item as operating lease liabilities.

A lessee must present in the statement of financial position (or disclose in the

notes thereto) (1) finance lease ROU assets separately from operating lease ROU assets and

(2) finance lease liabilities separately from operating lease liabilities. The rationale

for separate presentation is that the lease classifications differ with respect to the

subsequent-measurement patterns for their respective assets and, in the Board’s view,

represent economically different transactions. In addition, as discussed in paragraph BC57

of ASU 2016-02,

finance lease liabilities may not be presented with operating liabilities because finance

lease liabilities are the equivalent of debt and are generally treated as such in the

event of an entity’s bankruptcy. ASC 842 does not specifically prescribe which financial

statement line item is appropriate for presentation (e.g., separate presentation of

finance-lease ROU assets in a PP&E financial statement line item).

Connecting the Dots

Balance Sheet Presentation Is Favorable for

Debt Covenants

Preparers may be in favor of the requirement to present finance leases

separately from operating leases because this requirement may reduce an entity’s

exposure to potential debt covenant violations that could have resulted if the entity

was required to characterize all lease liabilities as debt. See the Connecting the Dots in Section 8.1.1 for more

information.

While the standard does not require distinct presentation on the face of the

statement of financial position, the assets and liabilities related to each lease

classification must be presented separately (i.e., in either distinct or separate

financial statement line items). A lessee that discloses the amounts in the notes must

also disclose in which financial statement line items the amounts are included in the

statement of financial position.

Connecting the Dots

SEC Regulation S-X Requirements Related to

Separate Presentation of Assets and Liabilities

SEC Regulation S-X, Rule 5-02, requires registrants to separately present, in

the balance sheet or a note thereto, (1) “other assets” that are in excess of 5

percent of total assets and (2) any item in excess of 5 percent of other current

liabilities and any other liability in excess of 5 percent of total liabilities.

Although these SEC Regulation S-X requirements do not appear to mandate any

disclosures that are not already prescribed by ASC 842, companies should nonetheless

consider the requirements in evaluating whether separate presentation on the face of

the financial statements is warranted.

When a lease arrangement would result in a negative ROU asset balance as of the

commencement date, the lessee should reduce the ROU asset down to zero and recognize the

difference as a liability, because it would be inappropriate to recognize a negative ROU

asset. For more information, see Section

8.4.2.3.

14.2.1.1 Considerations Related to Presentation of ROU Assets and Lease Liabilities in a Classified Statement of Financial Position

ASC 842-20

Statement of Financial Position

45-1 . . . Right-of-use assets and lease liabilities shall be subject to the same considerations as other nonfinancial assets and financial liabilities in classifying them as current and noncurrent in classified statements of financial position.

14.2.1.1.1 Presentation of ROU Assets in a Classified Statement of Financial Position

As stated above in ASC 842-20-45-1, the ROU asset “shall be subject

to the same considerations as other nonfinancial assets . . . in classifying them as

current and noncurrent in classified statements of financial position.” Therefore, an

entity that presents a classified balance sheet is not required to classify its ROU

assets as current and noncurrent. Entities typically exclude depreciated or amortized

assets (e.g., PP&E and intangible assets, respectively) from current assets in

accordance with ASC 210-10-45-4(f). Under ASC 842, ROU assets must be amortized and

are therefore akin to other amortizable assets.

14.2.1.1.2 Presentation of Lease Liabilities in a Classified Statement of Financial Position

As stated above in ASC 842-20-45-1, “lease liabilities shall be

subject to the same considerations as other . . . financial liabilities in classifying

them as current and noncurrent in classified statements of financial position.”

Therefore, an entity that presents a classified balance sheet must classify its lease

liabilities as current and noncurrent. ASC 210-10-45-6 states, in part, that the

“concept of current liabilities includes estimated or accrued amounts that are

expected to be required to cover expenditures within the year for known obligations.”

Therefore, an entity should classify the portion of its lease liabilities that it

expects to be required to pay within the year (or the entity’s operating cycle) as a

current liability.

As illustrated in the example below, the calculation of the current

portion of the liability includes the portion of the lease payments that will be

applied to the liability’s principal over the next 12 months. This observation is

consistent with the guidance in ASC 210-10-45-9, which states, in part, that current

liabilities should include “[o]ther liabilities whose regular and ordinary liquidation

is expected to occur within a relatively short period of time, usually 12 months.”

Example 14-1

On December 31, 20X2, Company X, a lessee, commenced a

lease with a term of three years and an annual lease payment of $4,660 due

on each anniversary of the commencement date. Company X uses a year (12

months) to classify other current assets and liabilities in its classified

balance sheet in accordance with ASC 210. After discounting the lease

payments at a discount rate of 8 percent, X determines that (1) its total

lease liability is $12,009 and (2) $3,699 of the liability will be paid

within one year from the balance sheet date. As of December 31, 20X2, X

classifies $3,699 as a current liability and the remaining $8,310 as a

noncurrent liability when it presents its classified balance sheet.

The table below illustrates the calculation of the

current liability in each year of the lease term by using an approach in

which the current portion of the liability is equal to the payment amount

to be applied to the liability’s principal.

Another acceptable approach for calculating the current portion of a lease liability

may be to include the present value of the lease payment(s) scheduled to be made over

the next 12 months.

In addition to the approaches described above, we are aware of

certain alternatives that entities may apply in determining the current portion of the

lease liability. We recommend that entities consult with their accounting advisers in

evaluating the reasonableness of any alternative applied.

14.2.1.1.3 Considerations When the Current Portion of a Lease Liability Would Be Negative

Section

6.2.2 discusses certain lease agreements that may include provisions

requiring lessors to make payments to lessees during the lease term (e.g., contractual

lease incentives in the form of reimbursements for leasehold improvements). These

lease incentives reduce a lessee’s total lease payments during the lease term. In some

circumstances, for example, when in conjunction with a rent-free period at the

beginning of a lease, it is possible that a lessee could expect to receive lease

incentives within one year from the balance sheet date that exceed the fixed rental

payments (i.e., outflows) due within that same period, resulting in a net cash inflow

for the next 12 months of the lease term. ASC 842-20-45-1 states that “lease

liabilities shall be subject to the same considerations as other . . . financial

liabilities in classifying them as current and noncurrent in classified statements of

financial position.” However, there is limited guidance in other GAAP that applies to

the classification of a financial liability with a current portion that is a net cash

inflow in the next 12 months.

In these situations, there is diversity in practice. We are aware of

the following two approaches that entities have applied in such circumstances:

-

Noncurrent lease liability — Under this common approach, an entity presents the entire lease liability, including the net cash inflow in the next 12 months, as a noncurrent lease liability. As discussed in Sections 6.2.2 and 8.5.4.3, lease incentives to be received during the lease term are lease payments that entities may treat1 as reductions of the lease liability. Because a lease arrangement is a single contract, the associated lease liability may be considered a single unit of account; accordingly, it is acceptable to present the lease liability as a single noncurrent lease liability even when the next 12 months are expected to yield a net cash inflow (i.e., representing a present right to receive cash). Supporters of this view believe that the arrangement is analogous to an unexercised draw-down of future debt in a manner consistent with the presentation guidance in ASC 842-20-45-1, which states that the “lease liabilities shall be subject to the same considerations as other . . . financial liabilities.” Accordingly, proponents of this view think that it is appropriate to present a lower noncurrent liability as of the balance sheet date since the lease liability is a single unit of account that, like a financial liability, the entity has the intent to repay over a term greater than 12 months and for which the obligation to repay that higher amount over the long term has not yet occurred. That is, when the cash is received, the noncurrent (financial) liability will increase to the amount of the expected future cash flows calculated in the lease’s amortization table.

-

Present current portion (to be received) as a current receivable — Another acceptable approach in our view is one in which an entity presents cash flows representing the current portion (i.e., the net cash inflow for the next 12 months) as a current asset (receivable). The ASC master glossary defines current assets as “other assets or resources commonly identified as those that are reasonably expected to be realized in cash or sold or consumed during the normal operating cycle of the business.” This definition supports the view that entities that are party to these leasing arrangements have a contractual right to receive cash in the normal operating cycle (i.e., within the next 12 months) and may record a current asset that provides a faithful representation of liquidity for the next 12 months. This view is similar to our views on classifying derivatives in hedging relationships with multiple settlements. That is, we believe that the amounts related to (all) the cash flows that must occur within one year of the balance sheet date would represent the current asset or current liability (see Section 6.2.2 of Deloitte’s Roadmap Hedge Accounting for more information).

We do not believe that it would be appropriate for a lessee to net

the current receivable associated with one lease arrangement against other short-term

lease liabilities from other lease contracts. In other words, when applying the

current receivable approach, an entity must present an asset as current either

separately or within an appropriate asset category. Also, in both approaches, entities

must present a current portion of a lease liability in accordance with the approach

outlined in Section

14.2.1.1.2 once there is no longer a net cash inflow under the lease

arrangement for the next 12 months.

The example below illustrates a leasing arrangement in which a

lessee must determine the classification of a lease liability that includes lease

incentives to be received in the next 12 months in excess of fixed rental payments

(i.e., outflows) to be made to the lessor in the next 12 months (i.e., the current

portion is a net cash inflow).

Example 14-2

Company A (Lessee) is party to a 10-year lease for an

office building with Landlord B (Lessor). The lease commencement date is

July 1, 20X1. The lease contains an 18-month free rent holiday between

July 1, 20X1, and December 31, 20X2; accordingly, fixed rental payments

commence on January 1, 20X3, and continue until the end of the lease term.

As an incentive for signing the lease, Lessor will provide Lessee with $10

million in reimbursements for leasehold improvements that Lessee is

planning on making to the property. While Lessee must submit receipts for

eligible expenditures to Lessor on or before June 31, 20X2 (for payment on

July 15, 20X2), Lessee has an expenditure budget greater than $15 million

and, upon lease commencement, has determined that it is probable that it

will receive the entire $10 million lease improvement allowance. Further,

Lessee has elected a policy of including the leasehold improvement

allowance in the measurement of the lease liability upon commencement.

Assume that other than fixed rental payments commencing on January 1,

20X3, and the leasehold improvement allowance to be received by Lessee, no

other lease payments are included in the contract.

As of lease commencement, Lessee has concluded the

following:

- The reimbursements received from Lessor represent lease incentives for leasehold improvements (rather than reimbursements for landlord-owned assets).

- Lessee is reasonably certain to complete the construction of leasehold improvements and receive 100 percent of the $10 million of reimbursements on July 15, 20X2. In a manner consistent with the discussion in Section 8.5.4.3, Lessee elects an accounting policy of including the lease incentive of $10 million within lease payments. Because Lessee believes that it is probable at lease commencement that the payments will be received, there is a reduction in the ROU asset and the lease liability.

- The lease is classified as an operating lease.

During the initial 18-month “free” rent period, the

lease contract does not require Lessee to make rental payments to Lessor,

and the only lease payment included in the measurement of the lease

liability is the $10 million lease incentive expected to be received (a

cash inflow to Lessee) on July 15, 20X2, which results in a net cash

inflow as of December 31, 20X1. In preparing the annual financial

statements as of December 31, 20X1, Lessee may present the entire lease

liability — including the measurement of (1) the $10 million lease

incentive receivable and (2) all contractual fixed rent payments

commencing on January 1, 20X3, and through the end of the lease term — as

a noncurrent lease liability.

It would also be acceptable for Lessee to present the

measurement of the net cash inflow in the next 12 months (i.e., the $10

million lease incentive) as a current receivable and to separately

present, as a noncurrent lease liability, the measurement of the combined

contractual fixed rent payments commencing on January 1, 20X3, and

continuing through the end of the lease term.

We believe that an entity may also apply the second presentation

approach discussed above (i.e., presentation of negative lease liability as a

receivable) when determining financial statement presentation for lease arrangements

that result in the recognition of a negative lease liability at lease commencement.

For example, a lease arrangement with a payment structure in which the fixed lease

payments are minimal or zero, and that also includes fixed lease incentives receivable

from the lessor during the lease term, would result in a negative lease liability at

lease commencement.

As discussed above, because of the complexities associated with such

lease arrangements, we recommend that entities consult with their accounting advisers

and auditors when establishing an acceptable policy in such situations.

14.2.2 Statement of Comprehensive Income

ASC 842-20

Statement of Comprehensive Income

45-4 In the statement of comprehensive income, a lessee shall present both of the following:

- For finance leases, the interest expense on the lease liability and amortization of the right-of-use asset are not required to be presented as separate line items and shall be presented in a manner consistent with how the entity presents other interest expense and depreciation or amortization of similar assets, respectively

- For operating leases, lease expense shall be included in the lessee’s income from continuing operations.

14.2.2.1 Finance Leases — Presentation of Interest Expense on the Lease Liability and Amortization Expense Related to the ROU Asset

The requirements for finance leases in ASC 842-20-45-4(a) with respect to

presentation of interest expense and amortization expense are in line with the FASB’s

view that a finance lease is economically similar to a financed asset purchase (i.e.,

the proceeds of a loan used to acquire an asset). Therefore, in a manner consistent with

a financed purchase transaction, an entity would incur interest expense on its financing

(loan) and would depreciate its asset acquired.

Connecting the Dots

Variable Lease Payments in Finance Leases

(or Sales-Type Leases and Direct Financing Leases)

ASC 842 is silent on the appropriate classification of variable lease expense

arising from finance leases. Many preparers have asked whether such expense should

be recognized as amortization, interest expense, or lease expense (in a manner

similar to recognition of an operating lease expense). Because of the variable and

often contingent nature of such expense and its exclusion from the balance sheet ROU

asset and liability, it does not involve the amortization of an asset or, similarly,

the accrual of interest against a liability balance. Therefore, questions have

arisen about how this expense should be recognized once the variability or

contingency is resolved (or is deemed probable in accordance with ASC 842-20-55-1)

and recognized as an expense (see Section

8.5.4 for a detailed discussion of a change in lease payments resulting

from the resolution of a contingency).

Paragraph BC271 of ASU 2016-02 states:

[T]he Board decided

that cash flows from operating leases and variable lease payments that are not

included in the lease liability should be classified as operating activities

because the corresponding lease costs, if recognized in the

statement of comprehensive income, will be presented in income from continuing

operations. The previous sentence notwithstanding, Topic 842 states that

lease payments capitalized as part of the cost of another asset (for example,

inventory or a piece of property, plant or equipment) should be classified in the

same manner as other payments for that asset. [Emphasis added]

Paragraph BC271 of ASU 2016-02 seems to indicate that, from the lessee’s

perspective, variable lease payments would be recognized in income from continuing

operations in a manner similar to operating lease expense. (By analogy, this could

also mean that variable lease payments from sales-type or direct financing leases

should be recognized as a component of income from continuing operations, rather

than as interest income.) Therefore, we believe that there is a basis for presenting

variable lease expense as lease expense (i.e., instead of as amortization or

interest).

However, we would accept presentation of variable lease expense in the statement

of comprehensive income as either (1) interest expense or (2) a component of income

from continuing operations (e.g., lease expense). (Similarly, we believe that

lessors could present variable lease income related to payments that are not

included in the initial measurement of a net investment in a sales-type or direct

financing lease as either interest income or lease income.) Entities should disclose

their presentation approach, if material.

14.2.2.2 Operating Leases — A Single Lease Expense

A lessee should evaluate its lease cost and, in a manner consistent with other

types of expenses, should classify the single lease expense as cost of sales; selling,

general, and administrative expenses; or another operating expense line item in the

entity’s statement of comprehensive income.

14.2.2.2.1 Presentation of Lease Expense for Operating Leases With Impaired ROU Assets

As discussed in Section 8.4.4, when recognizing an impairment of an ROU asset associated

with an operating lease, a lessee subsequently amortizes the ROU asset by using a

finance lease model approach (i.e., the ROU asset is amortized on a straight-line

basis, and incremental expense is recognized under the effective interest method). In

accordance with ASC 842-20-25-7, while the recognition pattern changes for operating

leases after impairment (i.e., the finance lease exhibits a “front-loaded” expense

profile because a higher liability corresponds to higher interest in earlier periods

of the lease coupled with a straight-line amortization of the ROU asset), the

character of the expense does not. Specifically, ASC 842-20-25-7 states:

After a right-of-use asset has been impaired in accordance with

paragraph 842-20-35-9, the single lease cost described in paragraph 842-20-25-6(a)

shall be calculated as the sum of the following:

- Amortization of the remaining balance of the right-of-use asset after the impairment on a straight-line basis, unless another systematic basis is more representative of the pattern in which the lessee expects to consume the remaining economic benefits from its right to use the underlying asset

- Accretion of the lease liability, determined for each remaining period during the lease term as the amount that produces a constant periodic discount rate on the remaining balance of the liability.

Despite the different pattern of expense recognition after

impairment, a lessee should not separately present its expense incurred between

interest expense and amortization of the ROU asset. Rather, these expenses must

continue to be presented as a “single” lease expense and must be included in the

lessee’s income from continuing operations in a manner consistent with its operating

lease classification.

14.2.2.2.2 Presentation of Lease Expense for Operating Leases Subject to Abandonment Accounting

As discussed in Section 8.4.4.1, for an

operating lease subject to an abandonment plan, an entity may either (1) fully

amortize the remaining balance of the ROU by the planned abandonment date (i.e., over

the shortened useful life) on a straight-line basis or (2) retain an overall

straight-line expense profile for the period between the date on which a decision is

made regarding the abandonment and the actual abandonment date.

Neither of the approaches described above retains a straight-line expense profile

over the full remaining term of the lease. While the pattern of expense recognition

over the remaining lease term of an operating lease subject to an abandonment plan

deviates from a “standard” straight-line recognition pattern otherwise applicable to

operating leases, we believe that an operating lessee should continue to present a

“single” lease expense after the abandonment decision date in the income statement in

a manner consistent with, and within the same financial statement line item as, the

presentation of the expense before the abandonment decision date.

14.2.2.2.3 Presentation of Gain or Loss Upon Early Termination of an Operating Lease

When a lessee recognizes a gain or loss upon the early termination of an operating

lease, the lessee should present that gain or loss within the “single” lease expense

in the operating lessee’s income from continuing operations.

14.2.3 Statement of Cash Flows

ASC 842-20

Statement of Cash Flows

45-5 In the statement of cash flows, a lessee shall classify all of the following:

- Repayments of the principal portion of the lease liability arising from finance leases within financing activities

- Interest on the lease liability arising from finance leases in accordance with the requirements relating to interest paid in Topic 230 on cash flows

- Payments arising from operating leases within operating activities, except to the extent that those payments represent costs to bring another asset to the condition and location necessary for its intended use, which should be classified within investing activities

- Variable lease payments and short-term lease payments not included in the lease liability within operating activities.

Upon commencement of an operating lease, a lessee records an ROU asset and a

lease liability. Such noncash activity should be disclosed (see Section 15.2.4.8). For operating leases, repayments of

liabilities should be classified in operating activities. Similarly, in a manner

consistent with the income statement presentation discussed in Section 14.2.2, when a lessee recognizes a gain or

loss upon the early termination of an operating lease, the lessee should present that

activity within operating activities in the statement of cash flows. If any payments made

for operating leases represent the costs of bringing another asset to the condition and

location necessary for its intended use, such amounts should be classified as investing

activities.

Upon commencement of a finance lease, a lessee records an ROU asset and lease

liability. The noncash activities will be reflected in the noncash investing and financing

disclosures (see Section

15.2.4.8). Such noncash activity should be included in the investing and

financing activities sections of the statement of cash flows for the asset and liability,

respectively. This is consistent with the guidance in ASC 230-10-50-4, which states:

Examples of noncash investing and financing transactions are converting

debt to equity; acquiring assets by assuming directly related liabilities, such as

purchasing a building by incurring a mortgage to the seller; obtaining a right-of-use asset in exchange for a lease liability; obtaining a

beneficial interest as consideration for transferring financial assets (excluding cash),

including the transferor’s trade receivables, in a securitization transaction; obtaining

a building or investment asset by receiving a gift; and exchanging noncash assets or

liabilities for other noncash assets or liabilities. [Emphasis added]

In addition to noncash disclosures associated with the initial recognition of a

lease, a lessee should also consider noncash disclosure requirements based on other

noncash changes (increases or decreases) to the lease balances, such as those resulting

from lease modifications or reassessment events.

When the lessee makes lease payments under a finance lease, the lessee should

reflect the principal portion of the payments as a cash outflow from a financing activity

in the statement of cash flows. The portion of finance lease payment that reflects the

interest payment should be classified as a cash outflow from an operating activity.

The example below illustrates the financial statement presentation for a finance

lease and operating lease.

Example 14-3

A lessee enters into a three-year lease and agrees to make the following annual

payments at the end of each year: $10,000 in year 1, $15,000 in year 2, and

$20,000 in year 3. The initial measurement of the ROU asset and liability to

make lease payments is $38,000 at a discount rate of 8 percent.

This table highlights the differences in accounting for the lease as a finance

lease and an operating lease:

For the finance lease model, the interest expense calculated is a function of

the lease liability balance and the discount rate (i.e., $38,000 multiplied by 8 percent

in year 1). For the finance lease, the lessee includes amortization expense as a noncash

add-back to the operating activities section of the statement of cash flows, which is

calculated on a straight-line basis ($38,000 divided by 3). The principal portion of the

cash payment is reflected in the financing section as principal paid. There is no need to

separately add interest expense since it is already included in net income in the

operating section. The supplemental section includes interest paid.

For the operating lease model, the lessee may include noncash lease expense as a noncash add-back to the operating section of the statement of cash flows ($15,000 – $3,038 = $11,962); this reflects the portion of the lease expense that amortized the ROU asset. While this presentation reflects a best practice, there may be other acceptable methods of presentation for the change in ROU assets; however, it would be inappropriate to present the change in ROU assets in amortization expense. Entities contemplating a different method of presentation are encouraged to discuss the method with their accounting advisers. The cash payment is reflected in the operating section as a change in operating liabilities. Because interest expense is not included in operating leases, there are no separate disclosures for this activity.

Footnotes

1

If the lease payments to be received during the lease term

are fixed, they must be treated as reductions to the lease liability.

However as described in Section 8.5.4.3, lessees that receive lease incentives during

the term that are based on the resolution of future contingencies may elect

to include lease payments in the measurement of the lease liability at lease

commencement if the receipt of those incentives from the lessor is probable

at lease commencement.

14.3 Lessor

14.3.1 Sales-Type and Direct Financing Leases

14.3.1.1 Statement of Financial Position

ASC 842-30

Sales-Type and Direct Financing Leases

Statement of Financial Position

45-1 A lessor shall present lease assets (that is, the aggregate of the lessor’s net investment in sales-type leases and direct financing leases) separately from other assets in the statement of financial position.

45-2 Lease assets shall be subject to the same considerations as other assets in classification as current or noncurrent assets in a classified balance sheet.

As noted above, “the aggregate of the lessor’s net investment in sales-type

leases and direct financing leases” must be presented “separately from other

assets in the statement of financial position.” In other words, these

balances must be presented discretely in the statement of financial position

and cannot be combined with other financial statement balances.

When presenting a classified balance sheet, a lessor must

classify its net investments in leases as current and noncurrent. While a

lessee does not need to present its ROU assets as current and noncurrent,

the same logic cannot be applied to a lessor’s net investment in the lease.

The net investment in a lease is a financial asset that is within the scope

of ASC 310; therefore, there is often a current balance, the amount that is

reasonably expected to be realized in cash during the normal operating cycle

of the business.

14.3.1.2 Statement of Comprehensive Income

ASC 842-30

Statement of Comprehensive Income

45-3 A lessor shall either present in the statement of comprehensive income or disclose in the notes income arising from leases. If a lessor does not separately present lease income in the statement of comprehensive income, the lessor shall disclose which line items include lease income in the statement of comprehensive income.

45-4 A lessor shall present any profit or loss on the lease recognized at the commencement date in a manner that best reflects the lessor’s business model(s). Examples of presentation include the following:

- If a lessor uses leases as an alternative means of realizing value from the goods that it would otherwise sell, the lessor shall present revenue and cost of goods sold relating to its leasing activities in separate line items so that income and expenses from sold and leased items are presented consistently. Revenue recognized is the lesser of:

- The fair value of the underlying asset at the commencement date

- The sum of the lease receivable and any lease payments prepaid by the lessee.

Cost of goods sold is the carrying amount of the underlying asset at the commencement date minus the unguaranteed residual asset. - If a lessor uses leases for the purposes of providing finance, the lessor shall present the profit or loss in a single line item.

Any income from sales-type leases (selling profit or loss and interest income)

or direct financing leases (interest income) must be included in the

statement of comprehensive income. To the extent that the amounts are not

presented separately, they should be disclosed in the notes to the financial

statements. See the Connecting the Dots in Section 14.2.2.1 for a discussion of

the presentation of income from variable lease payments.

Connecting the Dots

SEC Regulation S-X

Requirements Related to Income Statement

Presentation

SEC Regulation S-X, Rule 5-03, indicates the various

line items that should appear on the face of the income statement.

Specifically, a registrant should separately present any amounts

that represent 10 percent of the sum of income derived from net

sales of tangible products, operating revenues from public utilities

or others, income from rentals, revenues from services, and other

revenues. Although these SEC Regulation S-X requirements do not

appear to mandate any disclosures that are not already prescribed by

ASC 842, registrants should nonetheless consider the rule’s mandates

in evaluating whether separate presentation on the face of the

financial statements is warranted.

Revenue

Recognized

ASC 842-30-45-4(a) states that revenue recognized by

a lessor that “uses leases as an alternative means of realizing

value from the goods that it would otherwise sell” must be the

lesser of (1) the “fair value of the underlying asset at the

commencement date” or (2) the “sum of the lease receivable and any

lease payments prepaid by the lessee.” The intent of this guidance

is to ensure that a lessor reflects the substance of its

transactions — as either a seller or financier of a good —

regardless of whether the lease is a sales-type lease in form. It

would be more appropriate for a seller of a good to present the

gross sales proceeds and cost of the good sold, whereas a financier

may only present profit and interest income.

Example 14-4

Case A

One of Loman Inc.’s traveling salespeople enters into an arrangement to lease

props and other theater equipment to a customer,

Miller Theater Company. Although Loman typically

sells its equipment, Miller prefers to enter into a

lease because the lease requires payment streams

that are preferable to the full up-front selling

price. Loman determines that the lease is a

sales-type lease. The fair value of the theater

equipment is $10,000, and Loman’s cost is

$8,000.

The appropriate income statement presentation of Loman’s sales-type lease at

commencement is:

Case B

Assume the same facts as in Case A except that Loman Inc. is a financial institution and provides financing to various customers to purchase equipment. In this case, Loman uses leasing as a means of providing financing to customers rather than selling its assets. The only amount presented in the financial statements at commencement would be selling profit of $2,000 (the net effect of the prior calculated balances — that is, the net impact of $10,000 less $8,000). (Note that with the changes to the lessor’s lease classification, it is possible for a financier to obtain sales-type lease classification — see Section 9.2.)

14.3.1.2.1 Presentation of Sublease Income

The ASC master glossary defines a sublease as “[a]

transaction in which an underlying asset is re-leased by the lessee (or

intermediate lessor) to a third party (the sublessee) and the original

(or head) lease between the lessor and the lessee remains in effect.”

See Chapter 12 for additional

guidance on accounting for sublease arrangements.

From a balance sheet perspective, subleases generally must be presented

on a gross basis since they do not relieve the sublessor’s legal

obligation under the head lease. However, ASC 842 does not directly

address income statement presentation of subleases. While the amounts

paid to the original, third-party lessor are generally presented in the

income statement as a component of selling, general, and administrative

expenses or as part of cost of goods sold, questions have arisen

regarding how sublease income should be presented under ASC 842 — that

is, whether it would be appropriate to recognize sublease income on a

net basis (i.e., as an offset to the head lease expense) rather than on

a gross basis.

ASC 842 does not explicitly indicate whether it would be

acceptable to net, for income statement presentation purposes, sublease

income against the related head lease expense. Because subleases

generally must be presented on the balance sheet on a gross basis under

ASC 842, one might conclude that gross income statement presentation is

required as well. However, we believe that net presentation of sublease

activity in the income statement may be appropriate when the sublease

activity is outside an entity’s normal business operations (and thus

occurs infrequently) and when doing so would result in more meaningful

financial reporting information for financial statement users. For

example, in some instances, net presentation may better reflect the true

cost of leasing the underlying asset or may avoid distortion of

important financial statement metrics such as operating income (e.g.,

scenarios in which the recognition of the sublease income and head lease

expense on a gross basis would understate total operating income because

the sublease income would be recognized as a component of “other

income/expense (net)”). In such circumstances, net presentation within

selling, general, and administrative expenses or cost of goods sold may

be appropriate.

14.3.1.3 Statement of Cash Flows

ASC 842-30

Statement of Cash Flows

45-5 In the statement of cash

flows, a lessor shall classify cash receipts from

leases within operating activities. However, if the

lessor is within the scope of Topic 942 on financial

services — depository and lending, it shall follow

the guidance in paragraph 942-230-45-4 for the

presentation of principal payments received from

leases.

The guidance in ASC 842-30-45-5, as originally issued, was clear that cash

receipts from sales-type leases or direct financing leases are included in

operating activities in the statement of cash flows. However, the FASB staff

received questions from stakeholders because the example in ASC 942-230-55-2

conflicted with the guidance in ASC 842-30-45-5, as originally issued.

Specifically, the example in ASC 942 illustrates the direct method of cash

flows and presents “principal payments received under leases” in cash flows

from investing activities. (This example existed before, and was not

consequentially amended by, the issuance of ASC 842.) Accordingly, in March

2019, the Board issued ASU 2019-01, which addresses this

conflicting guidance by retaining the current guidance in ASC 942. Thus,

depository and lending lessors (those entities within the scope of ASC 942)

should continue to classify principal payments received from sales-type and

direct financing leases within “investing activities.” See Section E.3.1.7 for a

detailed discussion of ASU 2019-01.

14.3.2 Operating Leases

14.3.2.1 Statement of Financial Position

ASC 842-30

Statement of Financial Position

45-6 A lessor shall present the underlying asset subject to an operating lease in accordance with other Topics.

Because a lessor’s operating lease does not result in derecognition of the

underlying asset, the lessor should present the underlying asset in

accordance with other U.S. GAAP (e.g., ASC 360 on PP&E). Although there

is no prescriptive guidance on presenting deferred rent balances (i.e.,

straight-line rent), an entity should present such balances in accordance

with ASC 210.

Lessors must defer initial direct costs associated with

operating leases as a separate asset as of the commencement date and must

recognize these costs as an expense over the lease term on the same basis as

lease income (see Section

9.3.9.1). However, ASC 842 does not explicitly discuss

whether the deferred initial direct costs should be presented as a current

or noncurrent asset. Accordingly, we believe that either presentation is

acceptable, provided that it is applied consistently as an accounting

policy. Since the above approaches for presenting a lessor’s deferred

initial direct costs are also acceptable for classifying capitalized

contract costs under ASC 606 (see Section 14.6.3 of Deloitte’s Roadmap

Revenue Recognition), an

entity may find it useful to apply its selected presentation approach

consistently to deferred initial direct costs and capitalized contract

costs.

14.3.2.2 Statement of Comprehensive Income

The guidance on the statement of comprehensive income that applies to a lessor’s

operating leases is the same as that in ASC 842-30-45-3 (see Section

14.3.1.2).

Connecting the Dots

Presentation of Lease Revenue and Tenant Reimbursements in the

Financial Statements

As discussed in Section 4.4.1.1, in a typical

gross lease of real estate, the lessee pays a single fixed payment

that covers rent, property taxes, insurance, and CAM. Under ASC 840,

the portion of the single fixed payment attributable to property

taxes, insurance, and CAM was presented by real estate lessors as

“tenant reimbursements,” a separate revenue line item in a lessor’s

income statement. Under ASC 842, CAM is considered a nonlease

component (see Section 4.3.1) whereas reimbursements for property

taxes and insurance are noncomponents (see Section

4.3.2). Nonlease components are separated from lease

components and are generally accounted for in accordance with ASC

606 unless the lessor qualifies for and elects the practical

expedient related to combining the components (see Section

4.3.3.2). Furthermore, as discussed in Section

4.3.2, consideration in the contract is not allocated to

noncomponents because they do not transfer a good or service to the

lessee. Consideration for noncomponents is deemed part of the

overall consideration in the contract, which is allocated to lease

and nonlease components on a relative stand-alone selling price

basis.

If a lessor elects the practical expedient in ASU

2018-11 (discussed in Section 4.3.3.2) and therefore

combines lease and associated nonlease components (provided that

certain criteria are met), the lessor should present a single rental

revenue line item (as long as the lease component is predominant2) that includes the combined lease and nonlease components.

However, if a lessor does not qualify for or elect the practical

expedient, it should present the lease and nonlease components

separately. The resulting separate presentation typically will not

be aligned with the historical presentation under ASC 840.

Example 14-5

Lessor and Lessee enter into a five-year lease of a

floor in an office building. The contract stipulates

that Lessee is required to reimburse Lessor for the

costs related to the asset, including the real

estate taxes and Lessor’s performance of CAM at the

building. The lease commences on January 1,

20X1.

Lessee’s total payments for the year ended December

31, 20X1, are as follows:

Under ASC 840, many real estate

lessors presented the revenue components for this

type of lease agreement in two separate revenue line

items in the income statement, usually titled

“Rental Revenue” and “Tenant Reimbursement

Revenue.”

Sample

Presentation Under ASC 842 for Year Ended December

31, 20X1

If Lessor elects the practical

expedient related to not separating lease and

nonlease components (provided that the lease meets

the criteria under ASU 2018-11), rental revenue (the

lease component) and CAM (the nonlease component(s))

should be presented in a single line item in the

financial statements (i.e., rental revenues).

The

following is a sample presentation if Lessor has

elected the practical expedient under ASU

2018-11:

If Lessor has not elected the

practical expedient, lease and nonlease components

would be presented separately in the income

statement. Lease components are accounted for under

ASC 842, while nonlease components are accounted for

in accordance with other U.S. GAAP (typically ASC

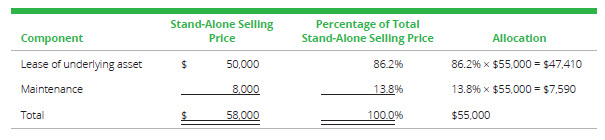

606). Assume that the stand-alone selling prices for

the lease of the underlying asset and maintenance

services are $50,000 and $8,000, respectively. The

property taxes paid by Lessee are a noncomponent,

and no consideration would be allocated to the

noncomponents. The total consideration would be

allocated between the lease component and the

nonlease component on the basis of the stand-alone

selling price.3

The table below

illustrates a sample presentation if Lessor does not

elect the practical expedient under ASU 2018-11.

Note that while we believe that the income statement

presentation of “tenant reimbursements” differs from previous practice under

ASC 840 (as described above), we understand that many real estate lessors

continue to provide this information given the performance metrics used by

analysts that cover the sector. Lessors that wish to disclose such

information in the financial statement footnotes should work with their

auditors to develop appropriate disclosures and, in doing so, should take

into consideration the rules related to non-GAAP measures.

14.3.2.3 Statement of Cash Flows

ASC 842-30

45-7 In the statement of cash flows, a lessor shall classify cash receipts from leases within operating activities.

Cash receipts from operating leases are included in operating activities in the statement of cash flows.

Footnotes

2

See Section 4.3.3.2.2 for

further discussion of how an entity determines which

component is predominant when applying the lessor practical

expedient to combine lease and nonlease components.

3

The allocation of the total

consideration in this example is calculated as

follows (see Section 4.4 for

further details on allocating consideration in a

contract):