Unpacking the Double Materiality Assessment Under the E.U. Corporate Sustainability Reporting Directive

Background

On July 31, 2023, the European Commission adopted a delegated

regulation on the European Sustainability Reporting Standards

(ESRS or “the standards”), which detail the requirements for companies within

the scope of the E.U. Corporate Sustainability Reporting Directive (EU)

2022/2464 (CSRD or “the directive”).1

The CSRD and ESRS introduce a “double materiality” concept that

consists of impact materiality and financial materiality; assessing double

materiality is a critical step in entities’ determination of the disclosures

required for sustainability reporting. To assess materiality under the CSRD,

entities identify information about material impacts, risks, and opportunities

(IROs) related to their business activities and relevant sustainability matters.

This publication discusses possible approaches to performing a double

materiality assessment under the CSRD and various factors that entities may want

to consider.2 For further information, see Deloitte’s August 17, 2023 (updated February

23, 2024), Heads Up on the

application of the CSRD to companies based in the United States.

What Is Double Materiality?

The CSRD explains that entities should disclose information that is material from

either an impact perspective or a financial perspective, or from both

perspectives. The directive establishes the “double materiality” terminology to

describe this concept, and the ESRS expand and clarify the approach and required

disclosures.

Sustainability matters that are material from an impact or financial perspective,

or both, have associated material IROs. ESRS 1 describes these terms as follows:

- Impacts — “[P]ositive and negative sustainability-related impacts that are connected with the undertaking’s business, as identified through an impact materiality assessment” (paragraph 14(a)).

- Risks and opportunities — An “undertaking’s sustainability-related financial risks and opportunities, including those deriving from dependencies on natural, human and social resources, as identified through a financial materiality assessment” (paragraph 14(b)).

The Double Materiality Assessment

There are four general steps that an entity may consider when

developing its double materiality assessment process and related internal

controls. While the ESRS include certain elements that are required within the

double materiality assessment, the guidance does not prescribe exactly how the

assessment should be conducted. Therefore, judgment is required to design a

process that (1) is in compliance with the standards and (2) reflects the

entity’s specific facts and circumstances. Furthermore, an entity should

consider how its double materiality assessment process may be affected by both

the IG 1: Materiality Assessment Implementation

Guidance and forthcoming implementation guidance related

to the ESRS.3

An entity may consider the following steps in its double materiality assessment process:

- Step 1 — Identify business activities, including those in the value chain.4

- Step 2 — Identify IROs.

- Step 3 — Determine which IROs are material.

- Step 4 — Conclude and prepare documentation.

Step 1 — Identify Business Activities, Including Those in the Value Chain

An entity may find it helpful to first identify the nature and extent of its

business activities and operations, including those in its value chain,

related to sustainability matters. The scope of this analysis should align

with the ESRS reporting level at which the entity has determined it should

report (e.g., subsidiary level or parent company level). To capture all of

an entity’s activities that may be related to a sustainability topic

(including activities of the entity’s value chain partners), the entity may

consider the following factors:

- Information included on the entity’s Web site or other external materials.

- The entity’s legal and regulatory environment.

- Media reports and publications about the entity and its industry.

- Peer reports and sector-specific benchmarks.

- Publications on sustainability trends and scientific findings.

By using the information gathered, the entity can identify its own business

activities — including upstream and downstream value chain activities and

the related dependencies, resources, business relationships, geographical

footprint, and affected stakeholders.

Upon completion of step 1, entities should have an

inventory of all activities to be included in the

double materiality assessment.

Step 2 — Identify IROs

The process of identifying IROs may be challenging, and it is likely to involve

activities such as those discussed below.

Engaging Stakeholders

Soliciting balanced and meaningful feedback from both internal and

external stakeholders is a critical part of the double materiality

assessment. While engagement with affected stakeholders or their

representatives is central to the process of identifying IROs, the

method of engagement can vary with respect to both the timing and manner

of engagement. For instance, an entity may obtain information from

external stakeholders before assessing double materiality to guide its

identification of IROs or it may obtain information after the assessment

to corroborate the results, or both. With regard to the manner of

engagement, the entity may obtain feedback in different ways, including

through proxy conversations, surveys, or interviews.

While included in step 2 for illustrative

purposes, engagement with affected stakeholders

should not be a one-time activity but rather a

part of an entity’s ongoing due diligence

process.

Identifying Sustainability Matters

ESRS 1, AR5 16, provides a list of sustainability matters that may be relevant

in the context of an entity’s business activities and value chain.

However, while the list of topics in AR 16 provides the starting point

for this analysis, sector-specific and entity-specific matters must also

be considered. Additional considerations that may inform this part of

the process could include (1) matters reported by the entity’s peers or

competitors, (2) matters raised by financial analysts, (3) relevant

regulations or sector standards (e.g., Sustainability Accounting

Standards Board [SASB], Global Reporting Initiative [GRI]), (4) matters

that are prevalent in the industry, (5) previously or voluntarily

reported information, or (6) other matters identified in the entity’s

ongoing due diligence process.

Example 1

Entity Z is a distributor of furniture and uses

its fleet of diesel-engine trucks to deliver

inventory to retailers. In addition to assessing

the list of matters in ESRS 1, AR 16, Z determines

whether there are any sector-specific or

entity-specific matters that are not included in

the list. As one example, Z evaluates the

regulations that it is subject to and identifies

vehicle maintenance standards and driving

standards as potentially relevant matters because

they are related to the well-being of both the

employee drivers and other drivers on the

roadways.

Note that the discussion in this example is for

illustrative purposes only and therefore is

limited to specific items and does not contemplate

all potentially relevant matters.

Determining Which Sustainability Matters Are Relevant

Once an entity has identified all (1) the “topics,

sub-topics and sub-sub-topics (collectively ‘sustainability

matters’)” from the list in ESRS 1, AR 16, and (2) the

sector-specific and entity-specific sustainability matters that it

believes could be relevant as described in the previous section,

it determines which of those matters are relevant and refines the

list to include only such matters. To do so, the entity may consider the

following questions about each sustainability matter:

- Is the matter regulated, or is disclosure of the matter required by a regulatory body?

- Is disclosure of the matter required by relevant industry SASB standards or GRI sector standards?

- Was the matter identified in a previous double materiality assessment?

- Has the matter been identified in any research conducted (by ESG analysts, peers, etc.)?

- Is the matter related to the entity’s (1) business activities or relationships or (2) value chain dependencies or resources, or is it in the financial, regulatory, geopolitical, or regulatory environments in which the entity operates?

Note that an entity is required to consider the list of sustainability

matters in ESRS 1, AR 16, as well as sector-specific and entity-specific

matters, and to then identify the material IROs. We expect that, in

practice, this will be an iterative process. Therefore, in step 2, an

entity may identify the sustainability matters that are relevant to its

business and value chain and may later determine whether the specific

sustainability matter is material on the basis of the materiality

determination of the associated IROs identified (see step 3). In

addition, an entity may identify IROs that prompt it to revisit its

preliminary conclusions regarding the relevance of particular

sustainability matters.

Example 2

Entity Z assesses the

"topics," “sub-topics,” and

“sub-sub-topics” listed in ESRS 1, AR 16, as well

as sector-specific and entity-specific matters,

and narrows down the list to include only relevant

matters. As part of that determination, Z

considers that its fleet of vehicles has diesel

engines that emit pollutants into the air and

concludes that these emissions are an inherent

consequence of its core business. Entity Z notes

that other distributors in similar industries

provide air pollution metrics and, therefore,

believes that its stakeholders and sustainability

statement users would expect it to provide the

same type of information. Therefore, Z determines

that the subtopic “Pollution of air” is

relevant.

In addition, the subtopic

”Pollution of water” may also be relevant since

trucking can cause water pollution via runoff from

roadways (i.e., if rain washes harmful pollutants

into bodies of water). While Z does not transport

toxic chemicals that could pollute the roadways,

its trucking activities can cause other types of

pollutants (oil, grease, fluid leakage), and

therefore Z determines that ”Pollution of water”

is a relevant subtopic.

As part of this step, Z also

eliminates matters that are clearly not

relevant. For example, Z determines that the

subtopic “Communities’ civil and political rights”

in ESRS 1, AR 16, is not relevant because its

business is not associated with or involved in any

community‘s “freedom of expression” or “freedom of

assembly,” nor does it have any “impact on human

rights defenders.”

Note that the discussion in this example is for

illustrative purposes only and therefore is

limited to specific items and does not contemplate

all potentially relevant matters.

Determining the IROs

After identifying the relevant sustainability matters, an entity should

analyze such matters to determine the associated IROs. Input from

stakeholders, qualitative information, and information from other sources

should be evaluated. An entity may seek to identify all sustainability IROs

first and then refine the list to include only material IROs in a later step

(see step 3).

Impacts

ESRS 1, Section 3.4, describes impacts as “actual or

potential, positive or negative impacts on people or the environment.” The specific

impacts associated with each sustainability matter are disaggregated

and defined in this step. For example, if an entity identifies

“substances of concern” as a relevant subtopic (see ESRS 1, AR 16),

it would then identify each individual substance of concern and

obtain information about each instance, such as the location, the

associated business activity, the quantity produced or procured, and

the environmental impact.

Financial Risks and Opportunities

In terms of financial risks and opportunities, ESRS 1, paragraph 49,

notes that a “sustainability matter is material from a financial

perspective if it triggers or could reasonably be expected to

trigger material financial effects on the

undertaking.” Specifically, a matter may be material from a

financial perspective if it materially affects or is expected to

materially affect an “undertaking’s development, financial position,

financial performance, cash flows, access to finance or cost of

capital.” An entity should consider events and circumstances that

may give rise to a financial effect, either currently or in the

future.

Impacts That May Generate Financial Risks and Opportunities

ESRS 1, paragraph 38, states that “[i]mpact materiality and financial materiality assessments

are inter-related” and requires an entity to consider the

“interdependencies between these two dimensions.” Thus, in addition

to identifying sustainability matters that generate a financial risk

or opportunity directly, the entity must also consider whether its

sustainability impacts have an indirect financial effect. As stated

in paragraph 91 of EFRAG’s IG 1: Materiality Assessment

Implementation Guidance, ”most impacts give rise to

financial risks and opportunities.”

An entity may consider the following factors when identifying risks

and opportunities related to each sustainability impact:

- Whether there are expected operational changes.

- Its ability to meet strategic goals.

- Its ability to adhere to regulations.

- The reputational effects of its environmental or social impacts.

- Decreased operating expenses resulting from investments in energy-efficient technologies.

- Increased capital expenditures associated with facility upgrades or modifications.

- New access to capital with more favorable terms and lower interest rates.

- Modifications made to assets because of changing weather patterns such as increased flood risks.

- Accelerated decommissioning of assets as a result of commitments or loss of financial viability.

- Incurrence of costs associated with stranded assets and associated redundancies.

- Increased training costs to upskill workforce for new products or services.

- A reduction in revenues linked to certain products or services.

- Increased insurance premiums or legal liabilities as a result of noncompliance with regulations, settlements, fines, or legal fees.

Example 3

Entity Z considers all the impacts associated

with air pollution that could result from its

trucking activities and compiles a list specifying

(1) each type of gas pollutant associated with

each vehicle type in its fleet and (2) the nature

of the environmental or social harm, or both, that

each pollutant may cause (i.e., impacts). Entity Z

also identifies sources of financial risks; it (1)

determines which of the jurisdictions in which it

operates imposes fines for exceeding emissions

limits and (2) considers that reputational damage

related to its pollutant emissions could result in

a shift in consumer demand for furniture delivered

by trucks with diesel engines (financial

risks).

Similarly, Z takes inventory of all its IROs

related to water pollution.

Note that the discussion in this example is for

illustrative purposes only and does not provide an

exhaustive list of matters and IROs. In addition

to the topical standard “Pollution” in ESRS E2,

air pollution related to greenhouse gases is also

covered in the ESRS E1 topical standard “Climate

change,” which Z evaluates separately.

Upon completion of step 2, entities should

have identified the IROs that need to be assessed

for materiality.

Step 3 — Determine Which IROs Are Material

In this step, an entity assesses the materiality of each IRO

identified in step 2. To do so, the entity may choose to use stakeholder

input, qualitative information, and information from its ongoing due

diligence to develop IRO scoring criteria. IRO scoring is an approach that

management may use to assign standardized ratings to each IRO for each of

the prescribed criteria on the basis of the specific characteristics of each

IRO. Although an entity will need to apply judgment when developing the

scoring criteria, it is also required to apply the appropriate thresholds

under ESRS 1. A leading practice is to ensure consistent scoring of IROs,

which in turn provides a sound foundation for the entity’s internal control

framework. Furthermore, a systematic and consistently applied rating

approach supports consistent execution of the steps, conclusions, and

related documentation needed to prepare for obtaining assurance for both

compliance and the double materiality assessment process.

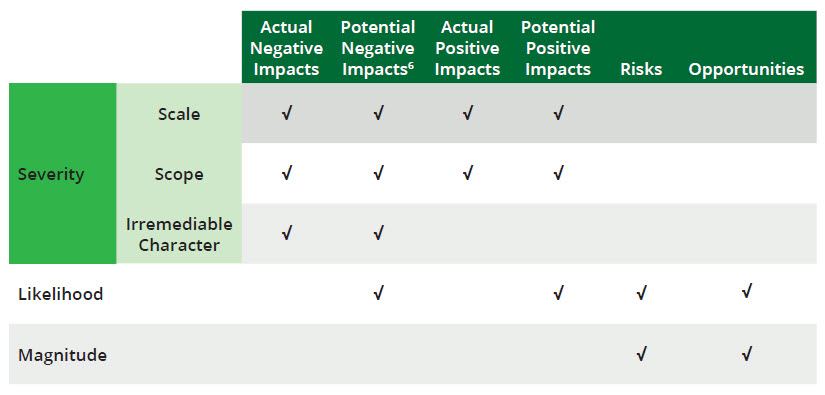

The indicators and thresholds used in a materiality

assessment under ESRS 1 may consist of quantitative information, qualitative

information, or both. The table below shows the criteria that ESRS 1

prescribes, depending on the type of IRO.

6

ESRS 1, paragraph 45, specifies that “[i]n

the case of a potential negative human rights impact, the

severity of the impact takes precedence over its

likelihood.”

As indicated in ESRS 1, AR 10, the “severity” of an IRO depends on its

“scale,” “scope,” and “irremediable character.” ESRS 1, AR 11, states that

“[a]ny of the three characteristics . . . can make a negative impact

severe.” When evaluating each IRO, an entity may want to consider factors

such as the following, as shown in the table above:

- Scale — How intense the negative or positive impacts are or potentially would be for people or the environment (e.g., substantial, major, moderate, minimal).

- Scope — How widespread or broad the negative or positive impacts are or potentially would be (e.g., high, moderate, low).7

- Irremediable character — How difficult it would be to remediate or reverse any actual damage (e.g., impossible, challenging, moderately difficult, easy).

- Likelihood — How probable it is that the potential impact will occur or that the risk or opportunity will materialize (e.g., almost certain, likely, possible, unlikely).

- Magnitude — How significant the financial effect would be if this risk or opportunity were to materialize (e.g., above or below the threshold).

The scoring of each criterion should be aggregated on the basis of the

approach and thresholds determined by the entity.

Example 4

Entity Z assesses each of the

impacts and risks identified in step 2 in accordance

with the relevant criteria outlined above and

considers the information gathered about each IRO,

including input and feedback from stakeholders. In

its analysis, Z determines that the potential

impacts of air pollutants are material on the basis

of the nature of the harm (scale), the quantity

emitted (scope), and the irremediable character of

the damage. Entity Z also aggregates the potential

regulatory fines from all jurisdictions. While it

assesses the likelihood of being subject to fines as

moderate (likely), Z determines that the magnitude

of such fines would be low (below the threshold);

therefore, it concludes that the total financial

risk related to fines is not material to users of

the general-purpose financial statements and does

not need to be disclosed. However, Z determines that

there are material financial risks related to

reduced consumer demand resulting from potential

reputational damage associated with the air

pollution.

In addition, Z assesses the severity

and likelihood of the impacts related to water

pollution caused by its trucking activities. Since Z

does not transport chemicals, the only sources of

pollutants are minor leaks from the trucks’ engines,

which are mitigated by regular inspection and

maintenance to help prevent the leakage of harmful

chemicals. Entity Z concludes that both the scale

and likelihood of the IROs associated with water

pollution are low (minimal and unlikely,

respectively) in the short, medium, and long-term.

On the basis of its materiality assessment, Z

determines that IROs related to water pollution are

not material.

Note that the discussion in this example is for

illustrative purposes only and does not contemplate

all IROs or factors that would be considered in the

scoring of the IROs.

Assurance Note

To facilitate compliance with ESRS 2 IRO-1 and IRO-2 and for

assurance purposes, entities should maintain documentation of

management’s decisions and outcomes for each IRO as part of their

detailed documentation of the materiality assessment. For example,

entities should describe how thresholds were determined and where

management used judgment in applying the thresholds.

Upon completion of step 3, entities should have

identified the IROs that are material.

Step 4 — Conclude and Prepare Documentation

After an entity has evaluated each IRO and reached a preliminarily conclusion

about whether it is material in relation to the thresholds defined by

management, the entity may want to reengage external stakeholders to

corroborate the double materiality assessment and gather additional

stakeholder feedback.

To prepare its sustainability disclosures, an entity may find it helpful to

map material IROs to related ESRS disclosure requirements and data points

within the relevant topical standard to determine the information to be

disclosed. If industry- and entity-specific IROs are determined to be

material, entity-specific disclosures8 must be provided to enable users to understand IROs.

Assurance Note

FAQ 12 of EFRAG’s IG 1: Materiality Assessment

Implementation Guidance notes that “it is reasonable to

expect a certain level of documentation to be needed for internal

purposes” and to “help assurance providers to perform their work.”

Entities should consider and anticipate the information that

assurance providers will need to render assurance reports. In

addition, information about the double materiality assessment

process, including management’s use of thresholds, is required to be

disclosed in accordance with ESRS 2 IRO-1 and IRO-2. Therefore, a

key step in obtaining assurance over an entity’s CSRD compliance is

to capture management’s judgments and conclusions in writing

throughout the double materiality process. The documentation should

also provide evidence of the entity’s ongoing due diligence

activities to ensure that all material IROs that exist during the

reporting period are identified, even if not reflected in the

initial assessment. Entities should maintain records of management’s

decisions and outcomes for each IRO as part of their detailed

documentation of the materiality assessment. For example, entities

should describe how thresholds were determined and applied.

At the end of this step, the entity will have a

completed double materiality assessment that

identifies all material IROs and records the

documentation of the double materiality assessment

process.

Interplay With the SEC Climate Rule and International Sustainability Standards Board Standards

SEC Climate Rule

Entities with reporting obligations under ESRS may also have

reporting obligations with the SEC. In March 2024, the SEC issued a

final

rule9 regarding climate matters that has been stayed pending judicial

review. While it is uncertain whether the rule will be issued as written,

modified, or not issued at all, entities should prepare to comply with the

new rule as well as with existing SEC rules regarding MD&A, legal

proceedings, and risk factors (which may capture other material

sustainability matters beyond climate). As a result, SEC registrants may

need to include disclosures about material sustainability matters. In doing

so, registrants must apply the definition of “material” established in U.S.

Supreme Court rulings, which states that “a matter is material if there is a

substantial likelihood that a reasonable investor would consider it

important when determining whether to buy or sell securities or how to vote

or such a reasonable investor would view omission of the disclosure as

having significantly altered the total mix of information made

available.”

While the guidance on financial materiality in ESRS and in the SEC’s

definition of materiality are different, many of the underlying concepts are

generally similar and, in many cases, overlapping. However, the double

materiality approach under ESRS further requires companies to disclose

matters that may be material from an impact perspective. For example, if a

U.S. multinational registrant provides a consolidated sustainability report

in accordance with ESRS at the enterprise level to satisfy the requirements

of its E.U. subsidiaries in the scope of the CSRD, the reporting entity for

both the CSRD/ESRS report and its SEC filing will be the same. In such a

case, the more prescriptive requirements for identifying material matters

under ESRS may lead a registrant to reassess the matters to be disclosed for

SEC reporting purposes, except for matters that are only deemed to be

material from an impact perspective. We believe, however, that matters that

are preliminarily determined to only be material from an impact perspective

under ESRS could potentially lead to financial risks that may have a

material impact on a registrant’s future operations, such as through legal

liabilities or reputational harm.

Because of the number of ESG topics covered by ESRS and the related ESRS

disclosure requirements and datapoints, we believe that U.S. companies may

evaluate the population of sustainability matters in their double

materiality assessment at a more granular level than has previously been

applied in practice. In addition, as a result of the ongoing sustainability

due diligence process required by the ESRS, which informs the materiality

assessment process, registrants may identify more activities that may be

considered for SEC disclosure purposes than are currently addressed as

sustainability matters in SEC registrants’ disclosures. Companies should

further implement the appropriate processes and controls for collecting

sufficient information to conduct a thorough materiality assessment and

document both quantitative and qualitative considerations. Such matters may

include (1) their conclusions regarding which matters must be disclosed

under each regulation and (2) their rationale and support for any

differences in the matters disclosed under different regulations (e.g.,

matters may be material for disclosure in CSRD/ESRS reports but not for

disclosure in SEC reports).

ISSB Guidance

On May 2, 2024, EFRAG and the International Sustainability

Standards Board (ISSB) jointly published interoperability guidance. According to the press

release, the guidance is intended to “reduce complexity, fragmentation and

duplication for companies applying both the ISSB Standards and ESRS.” The

guidance states:

The financial materiality assessment in ESRS 1

corresponds to the identification of information that is material

for primary users of general purpose financial reports in making

decisions relating to providing resources to the entity (see

paragraph 48 of ESRS 1 and paragraph 18 of IFRS S1). The definition

of information that is considered material for users of general

purpose financial reports is therefore aligned between the two sets

of standards.

This alignment means that in assessing whether a

particular disclosure is considered material in applying ISSB

Standards, that assessment is aligned with the assessment of whether

that disclosure is financially material in accordance with ESRS, and

conversely.

Although EFRAG and the ISSB noted that their guidance is aligned in terms of

financial materiality, the double materiality approach under ESRS requires

companies to disclose additional matters that may be material from an impact

perspective. In addition, ESRS require companies to evaluate sustainability

matters that are incremental to those currently covered in IFRS S1 and S2.

Lastly, the interoperability guidance must be considered in conjunction with

the ESRS and ISSB standards, and entities will need to comply with all the

requirements of both standards to claim they are reporting in accordance

with either one.

Contacts

|

|

Eric Knachel

Audit &

Assurance

Partner

Deloitte &

Touche LLP

+1 203 761

3625

|

|

Doug Rand

Audit &

Assurance

Managing

Director

Deloitte &

Touche LLP

+1 202 220

2754

|

|

Sara Raquel Macferran

Audit &

Assurance

Senior Manager

Deloitte &

Touche LLP

+1 813 769

6174

|

Ragan Powell

Audit &

Assurance

Senior Manager

Deloitte &

Touche LLP

+1 469 417

2356

|

Footnotes

1

“Directive (EU) 2022/2464 of the European Parliament and

of the Council.”

2

For additional considerations, see the European Financial Reporting

Advisory Group (EFRAG) publication IG 1: Materiality Assessment Implementation

Guidance, which discusses one possible approach

to performing the double materiality assessment and includes examples of

IROs arising from sustainability matters.

3

See the Web sites of EFRAG

and the European Commission for information

on the additional guidance that is expected to be released.

4

ESRS Annex II defines value chain, in part, as “the full range of

activities, resources and relationships related to the

undertaking’s business model and the external environment in

which it operates.” For further information, see the EFRAG

publication IG 2: Value Chain Implementation

Guidance.

5

“AR” refers to the “Application Requirements” section in ESRS 1,

Appendix A.

6

ESRS 1, paragraph 45, specifies that “[i]n

the case of a potential negative human rights impact, the

severity of the impact takes precedence over its

likelihood.”

7

As noted in ESRS 1, AR 10, ”[i]n the case of

environmental impacts, the scope may be understood as the

extent of environmental damage or a geographical perimeter.

In the case of impacts on people, the scope may be

understood as the number of people adversely affected.”

8

See ESRS 1, AR 1 through AR 5, for information about the application

requirements for entity-specific disclosures.

9

SEC Final Rule Release No. 33-11275, The

Enhancement and Standardization of Climate-Related Disclosures

for Investors.