FASB Issues Final Standard on Accounting for Credit Losses

Yesterday, the FASB issued ASU 2016-13,1 which amends the Board’s guidance on the

impairment of financial instruments. The ASU adds to U.S. GAAP an impairment model

(known as the current expected credit loss (CECL) model)2 that is based on expected losses

rather than incurred losses. Under the new guidance, an entity recognizes as an allowance

its estimate of expected credit losses, which the FASB believes will result in more timely

recognition of such losses. The ASU is also intended to reduce the complexity of U.S. GAAP

by decreasing the number of credit impairment models that entities use to account for debt

instruments.

Once effective (see the Effective Date discussion below), the new guidance will significantly

change the accounting for credit impairment. Banks and certain asset portfolios (e.g., loans,

leases, debt securities) will need to modify their current processes for establishing an

allowance for loan and lease losses and other-than-temporary impairments to ensure that

they comply with the ASU’s new requirements. To do so, they will need to make changes to

their operations and systems associated with credit modeling, regulatory compliance, and

technology.

Editor’s Note

In late 2015, the FASB established a transition resource group (TRG) for credit losses.

Like the TRG for the new revenue recognition standard, the credit losses TRG does

not issue guidance but provides feedback to the FASB on potential implementation

issues. By analyzing and discussing such issues, the TRG helps the Board determine

whether it needs to take further action (e.g., by clarifying or issuing additional

guidance). The credit losses TRG’s first public meeting was April 1, 2016. For more

information about that meeting and the credit losses TRG, see Deloitte’s April 2016

TRG Snapshot.

This Heads Up discusses the ASU’s changes to the guidance on credit impairment under

current U.S. GAAP. The examples in Appendix A and Appendix B illustrate how an entity might

apply the CECL model to purchased financial assets with credit deterioration (“PCD assets”)

and to trade receivables, respectively.

The CECL Model

Scope

The CECL model applies to most3 debt instruments (other than those measured at fair value),

trade receivables, lease receivables, reinsurance receivables that result from insurance

transactions, financial guarantee contracts,4 and loan commitments. However, availablefor-

sale (AFS) debt securities are excluded from the model’s scope and will continue

to be assessed for impairment under the guidance in ASC 3205 (the FASB moved the

impairment model for AFS debt securities from ASC 320 to ASC 326-30 and has made limited

amendments to the impairment model for AFS debt securities, as discussed below).

Recognition of Expected Credit Losses

Unlike the incurred loss models in existing U.S. GAAP, the CECL model does not specify a threshold for the recognition of an impairment allowance. Rather, an entity will recognize its estimate of expected credit losses for financial assets as of the end of the reporting period. Credit impairment will be recognized as an allowance — or contra-asset — rather than as a direct write-down of the amortized cost basis of a financial asset. However, the carrying amount of a financial asset that is deemed uncollectible will be written off in a manner consistent with existing U.S. GAAP.

Editor’s Note

Because the CECL model does not have a minimum threshold for recognition of impairment losses, entities will need to measure expected credit losses on assets that have a low risk of loss (e.g., investment-grade held-to-maturity (HTM) debt securities). However, the ASU states that “an entity is not required to measure expected credit losses on a financial asset . . . in which historical credit loss information adjusted for current conditions and reasonable and supportable forecasts results in an expectation that nonpayment of the [financial asset’s] amortized cost basis is zero.” U.S. Treasury securities and certain highly rated debt securities may be assets the FASB contemplated when it decided to allow an entity to recognize zero credit losses on an asset, but the ASU does not so indicate. Regardless, there are likely to be challenges associated with measuring expected credit losses on financial assets whose risk of loss is low.

Measurement of Expected Credit Losses

The ASU describes the impairment allowance as a “valuation account that is deducted from the amortized cost basis of the financial asset(s) to present the net carrying value at the amount expected to be collected on the financial asset.” An entity can use a number of measurement approaches to determine the impairment allowance. Some approaches project future principal and interest cash flows (i.e., a discounted cash flow method) while others project only future principal losses. Regardless of the measurement method used, an entity’s estimate of expected credit losses should reflect those losses occurring over the contractual life of the financial asset.

When determining the contractual life of a financial asset, an entity is required to consider expected prepayments either as a separate input in the determination or as an amount embedded in the credit loss experience that it uses to estimate expected credit losses. The entity is not allowed to consider expected extensions of the contractual life unless it reasonably expects to execute a troubled debt restructuring with the borrower by the reporting date.

An entity must consider all available relevant information when estimating expected credit losses, including details about past events, current conditions, and reasonable and supportable forecasts and their implications for expected credit losses. That is, while the entity is able to use historical charge-off rates as a starting point for determining expected credit losses, it has to evaluate how conditions that existed during the historical charge-off period may differ from its current expectations and accordingly revise its estimate of expected credit losses. However, the entity is not required to forecast conditions over the contractual life of the asset. Rather, for the period beyond the period for which the entity can make reasonable and supportable forecasts, the entity reverts to historical credit loss experience.

Editor’s Note

It will most likely be challenging for entities, particularly financial institutions, to measure expected credit losses. Further, one-time or recurring costs may be associated with the measurement, some of which may be related to system changes and data collection. While such costs will vary by institution, nearly all entities will incur some costs when using forward-looking information to estimate expected credit losses over the contractual life of an asset.

Unit of Account

The CECL model does not prescribe a unit of account (e.g., an individual asset or a group of financial assets) in the measurement of expected credit losses. However, an entity is required to evaluate financial assets within the scope of the model on a collective (i.e., pool) basis when assets share similar risk characteristics. If a financial asset’s risk characteristics are not similar to the risk characteristics of any of the entity’s other financial assets, the entity would evaluate the financial asset individually. If the financial asset is individually evaluated for expected credit losses, the entity would not be allowed to ignore available external information such as credit ratings and other credit loss statistics.

Editor’s Note

The ASU requires an entity to collectively measure expected credit losses on financial assets that share similar risk characteristics (including HTM securities). While certain loans are pooled or evaluated collectively under current U.S. GAAP, entities may need to refine their data-capturing processes to comply with the new requirements.

Practical Expedients for Measuring Expected Credit Losses

The ASU permits entities to use practical expedients to measure expected credit losses for the following two types of financial assets:

- Collateral-dependent financial assets6 — Consistently with its practice under existing U.S. GAAP, an entity is permitted to measure its estimate of expected credit losses for collateral-dependent financial assets as the difference between the financial asset’s amortized cost and the collateral’s fair value (adjusted for selling costs, when applicable).

- Financial assets for which the borrower must continually adjust the amount of securing collateral (e.g., certain repurchase agreements and securities lending arrangements) — An entity is permitted to measure its estimate of expected credit losses on these financial assets as the difference between the amortized cost basis of the asset and the collateral’s fair value.

Write-Offs

Like current guidance, the ASU requires an entity to write off the carrying amount of a financial asset when the asset is deemed uncollectible. However, unlike current requirements, the ASU’s write-off guidance also applies to AFS debt securities.

AFS Debt Securities

The CECL model does not apply to AFS debt securities. Instead, the FASB decided to make targeted improvements to the existing other-than-temporary impairment model in ASC 320 for certain AFS debt securities to eliminate the concept of “other than temporary” from that model.7 Accordingly, the ASU states that an entity:

- Must use an allowance approach (vs. permanently writing down the security’s cost basis).

- Must limit the allowance to the amount at which the security’s fair value is less than its amortized cost basis.

PCD Assets

For PCD assets,8 the ASU requires an entity’s method for measuring expected credit losses

to be consistent with its method for measuring expected credit losses for originated and

purchased non-credit-deteriorated assets. Upon acquiring a PCD asset, the entity would

recognize its allowance for expected credit losses as an adjustment that increases the cost

basis of the asset (the “gross-up” approach). After initial recognition of the PCD asset and its

related allowance, the entity would continue to apply the CECL model to the asset — that

is, any changes in the entity’s estimate of cash flows that it expects to collect (favorable or

unfavorable) would be recognized immediately in the income statement. Interest income

recognition would be based on the purchase price plus the initial allowance accreting to the

contractual cash flows. See Appendix A for an example of how to apply the ASU’s guidance to

PCD assets.

Editor’s Note

Under current U.S. GAAP, an acquired asset is considered credit-impaired when it is probable that the investor would be unable to collect all contractual cash flows as a result of deterioration in the asset’s credit quality since origination. Under the ASU, a PCD asset is an acquired asset that has experienced a more-than-insignificant deterioration in credit quality since origination. Consequently, entities will most likely need to use more judgment than they do under current guidance to determine whether an acquired asset has experienced significant credit deterioration.

Also, under the current accounting for purchased credit-impaired assets, an entity recognizes unfavorable changes in expected cash flows as an immediate credit impairment but treats favorable changes in expected cash flows that are in excess of the allowance as prospective yield adjustments. The CECL model’s approach to PCD assets eliminates this asymmetrical treatment in cash flow changes. However, in a manner consistent with current practice, the CECL model precludes an entity from recognizing as interest income the discount embedded in the purchase price that is attributable to expected credit losses as of the date of acquisition.

Certain Beneficial Interests Within the Scope of ASC 325-40

Under the ASU, entities should measure an impairment allowance for purchased or retained beneficial interests in the same manner as PCD assets if the beneficial interest meets the definition of a PCD asset or there is a significant difference between the contractual cash flows and expected cash flows of the beneficial interest. At initial recognition, a beneficial interest holder would therefore present an impairment allowance equal to the estimate of expected credit losses. In addition, the ASU requires entities to accrete changes in expected cash flows attributable to factors other than credit into interest income over the life of the asset.

Editor’s Note

Under the CECL model, an entity would be required to determine the contractual cash flows of beneficial interests in securitized transactions. However, the beneficial interests in certain structures may not have contractual cash flows (e.g., when a beneficial interest holder receives only residual cash flows of a securitization structure). In these situations, the entity may need to use a proxy for the contractual cash flows of the beneficial interest (e.g., the gross contractual cash flows of the underlying debt instrument).

Loan Commitments

Off-balance-sheet arrangements such as commitments to extend credit, guarantees, and standby letters of credit that are not considered derivatives under ASC 815 are subject to credit risk and are therefore within the scope of the CECL model. Accordingly, the ASU requires an entity’s method for determining the estimate of expected credit losses on the funded portion of a loan commitment to be similar to its method for determining the estimate for other loans. For an unfunded portion of a loan commitment, an entity must estimate expected credit losses over the full contractual period over which the entity is exposed to credit risk under an unconditional present legal obligation to extend credit. Such an estimate takes into account both the likelihood that funding will occur and the expected credit losses on commitments to be funded.

Editor’s Note

An entity’s estimate of expected credit losses on unfunded loan commitments (e.g., credit card receivables) will depend on (1) whether the entity has the unconditional ability to cancel the commitment to extend credit and, if so, (2) the time it takes for the cancellation to become effective. It is our understanding that if an entity has the unconditional ability to cancel the unfunded portion of a loan commitment, the entity would not be required to estimate expected credit losses on that portion, even if the entity has historically never exercised its cancellation right.

Disclosures

Many of the disclosures required under the ASU are similar to those already required under U.S. GAAP.9 Accordingly, entities must disclose information about:

- Credit quality.10

- Allowances for expected credit losses.

- Their policies for determining write-offs.

- Past-due status.

- Nonaccrual status.

- PCD assets.

- Collateral-dependent financial assets.

In addition, other disclosures are required as follows:

- Public business entities that meet the U.S. GAAP definition of an SEC filer11 must disclose credit quality indicators disaggregated by year of origination for a five-year period.

- Public business entities that do not meet the U.S. GAAP definition of an SEC filer must disclose credit quality indicators disaggregated by year of origination. However, upon adoption of the ASU, they would only be required disclose such information for the previous three years, and would add another year of information until they have provided disclosures for the previous five years.

- Other entities are not required to disclose credit quality indicators disaggregated by year of origination.

Effective Date and Transition

Effective Date

For public business entities that meet the U.S. GAAP definition of an SEC filer, the ASU is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years.

For public business entities that do not meet the U.S. GAAP definition of an SEC filer, the ASU is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years.

For all other entities, the ASU is effective for fiscal years beginning after December 15, 2020,

and interim periods within those fiscal years beginning after December 15, 2021.

In addition, entities are permitted to early adopt the new guidance for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years.

Transition Approach

For most debt instruments, entities must record a cumulative-effect adjustment to the statement of financial position as of the beginning of the first reporting period in which the guidance is effective (modified retrospective approach). However, the ASU provides the following instrument-specific transition guidance:

- Other-than-temporarily impaired debt securities — An entity is required to apply(1) the CECL model prospectively to HTM debt securities and (2) the changes tothe impairment model for AFS debt securities prospectively. As a result, previous write-downs of a debt security’s amortized cost basis would not be reversed; rather, only changes in the estimate of expected cash flows of the debt security occurring on or after the ASU’s effective date would be reflected as an allowance for credit losses. Upon adoption of the new guidance, any impairment previously recognized in OCI would be accounted for as a prospective adjustment to the accretable yield of the debt instrument.

- PCD assets — An entity is required to apply the changes to PCD assets prospectively. That is, the change in the definition of a PCD asset applies only to assets acquired on or after the ASU’s effective date. For debt instruments accounted for under ASC 310-30, an entity would apply the gross-up approach as of the transition date (i.e., establish an allowance for expected credit losses with a corresponding adjustment to the debt instrument’s cost basis).In addition, an entity would immediately recognize any postadoption changes toits estimate of cash flows that it expects to collect (favorable or unfavorable) in the income statement as impairment expense (or reduction of expense). Accordingly, the yield on a PCD asset as of the date of adoption would be “locked” and would not be affected by subsequent changes in the entity’s estimate of expected credit losses.

- Certain beneficial interests within the scope of ASC 325-40 — Entities holding such interests need to comply with the same transition requirements as those that apply to PCD assets.

Transition Disclosures

An entity must disclose the following upon its adoption of the new guidance:

- “The nature of the change in accounting principle, including an explanation of the newly adopted accounting principle.”

- “The method of applying the change.”

- “The effect of the adoption on any line item in the statement of financial position, if material, as of the beginning of the first period for which the pending content that links to this paragraph is effective. Presentation of the effect on financial statement subtotals is not required.”

- “The cumulative effect of the change on retained earnings or other components of equity in the statement of financial position as of the beginning of the first period for which the pending content that links to this paragraph is effective.”

In addition, “an entity that issues interim financial statements shall provide the [above disclosures] in each interim financial statement of the year of change and the annual financial statement of the period of the change.”

Appendix A — Application of the CECL Model to PCD Assets

The example below, which is reproduced from ASC 326-20-55-63 through 55-65 (Example 12), illustrates the application of the ASU’s guidance to PCD assets.11

Bank O records purchased financial assets with credit deterioration in its existing systems by recognizing the amortized cost basis of the asset, at acquisition, as equal to the sum of the purchase price and the associated allowance for credit loss at the date of acquisition. The difference between amortized cost basis and the par amount of the debt is recognized as a noncredit discount or premium. By doing so, the credit-related discount is not accreted to interest income after the acquisition date.

Assume that Bank O pays $750,000 for a financial asset with a par amount of $1 million. The instrument is measured at amortized cost basis. At the time of purchase, the allowance for credit losses on the unpaid principal balance is estimated to be $175,000. At the purchase date, the statement of financial position would reflect an amortized cost basis for the financial asset of $925,000 (that is, the amount paid plus the allowance for credit loss) and an associated allowance for credit losses of $175,000. The difference between par of $1 million and the amortized cost of $925,000 is a non-credit related discount. The acquisition-date journal entry is as follows:

Subsequently, the $75,000 noncredit discount would be accreted into interest income over the life of the financial asset . . . . The

$175,000 allowance for credit losses should be updated in subsequent periods . . . , with changes in the allowance for credit losses

on the unpaid principal balance reported immediately in the statement of financial performance as a credit loss expense.

Appendix B — Application of the CECL Model to Trade Receivables

The CECL model applies to trade receivables that result from revenue transactions within the scope of ASC 605 (or ASC

606, if adopted). The example below, which is reproduced from ASC 326-20-55-38 through 55-40 (Example 5), illustrates

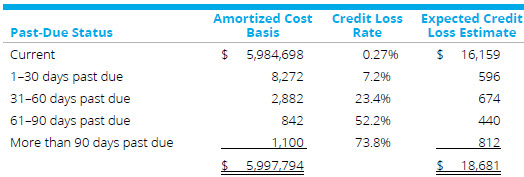

how an entity would apply the proposed guidance to trade receivables by using a provision matrix.13

Entity E manufactures and sells products to a broad range of customers, primarily retail stores. Customers typically are provided

with payment terms of 90 days with a 2 percent discount if payments are received within 60 days. Entity E has tracked historical

loss information for its trade receivables and compiled the following historical credit loss percentages:

- 0.3 percent for receivables that are current

- 8 percent for receivables that are 1–30 days past due

- 26 percent for receivables that are 31–60 days past due

- 58 percent for receivables that are 61–90 days past due

- 82 percent for receivables that are more than 90 days past due.

Entity E believes that this historical loss information is a reasonable base on which to determine expected credit losses for trade receivables held at the reporting date because the composition of the trade receivables at the reporting date is consistent with that used in developing the historical credit-loss percentages (that is, the similar risk characteristics of its customers and its lending practices have not changed significantly over time). However, Entity E has determined that the current and reasonable and supportable forecasted economic conditions have improved as compared with the economic conditions included in the historical information. Specifically, Entity E has observed that unemployment has decreased as of the current reporting date, and Entity E expects there will be an additional decrease in unemployment over the next year. To adjust the historical loss rates to reflect the effects of those differences in current conditions and forecasted changes, Entity E estimates the loss rate to decrease by approximately 10 percent in each age bucket. Entity E developed this estimate based on its knowledge of past experience for which there were similar improvements in the economy.

At the reporting date, Entity E develops the following aging schedule to estimate expected credit losses.

Editor’s Note

The ASU’s example highlights that an entity’s application of the CECL model to trade receivables through the use of a provision matrix may not differ significantly from the entity’s current methods for determining the allowance for doubtful accounts. However, the example illustrates that when an entity uses a provision matrix to estimate credit losses on trade receivables, it would be required to do the following when moving to an expected loss model:

- Under the CECL model, the entity would be required to consider whether expected credit losses should be recognized for trade receivables that are considered “current” (i.e., not past due). In the example above, a historical loss rate of 0.3 percent is applied to the trade receivables that are classified as current.

- When using historical loss rates in a provision matrix, the entity would be required to consider whether and, if so, how the historical loss rates differ from what is currently expected over the life of the trade receivables (on the basis of current conditions and reasonable and supportable forecasts about the future).

Footnotes

1

FASB Accounting Standards Update No. 2016-13, Measurement of Credit Losses on Financial Instruments.

2

Although the impairment project began as a joint FASB and IASB effort, constituent feedback on the boards’ “dual-measurement”

approach led the FASB to develop its own impairment model. The IASB, however, continued to develop the dual-measurement

approach and issued final impairment guidance based on that model as part of its July 2014 amendments to IFRS 9. For more

information about the IASB’s impairment model, see Deloitte’s August 8, 2014, Heads Up.

3

The following debt instruments would not be accounted for under the CECL model:

- Loans made to participants by defined contribution employee benefit plans.

- Policy loan receivables of an insurance entity.

- Pledge receivables (promises to give) of a not-for-profit entity.

- Loans and receivables between entities under common control.

4

The CECL model does not apply to financial guarantee contracts that are accounted for as insurance or measured at fair value

through net income.

5

For titles of FASB Accounting Standards Codification (ASC) references, see Deloitte’s “Titles of Topics and Subtopics in the FASB

Accounting Standards Codification.”

6

The ASU defines a “collateral-dependent financial asset” as a “financial asset for which the repayment is expected to be provided

substantially through the operation or sale of the collateral when the borrower is experiencing financial difficulty based on the

entity’s assessment as of the reporting date.” Under the definition in current U.S. GAAP, an entity is not required to assess the

borrower’s financial wherewithal when determining whether the financial asset is collateral-dependent.

7

The amendments do not apply to an AFS debt security that an entity intends to sell or will more likely than not be required to sell

before the recovery of its amortized cost basis. If an entity intends to sell or will more likely than not be required to sell a security

before recovery of its amortized costs basis, the entity would write down the debt security’s amortized cost to the debt security’s fair

value as required under existing U.S. GAAP.

8

The ASU defines PCD assets as “[a]cquired individual financial assets (or acquired groups of financial assets with similar risk

characteristics) that, as of the date of acquisition, have experienced a more-than-insignificant deterioration in credit quality since

origination, as determined by an acquirer’s assessment.”

9

See the disclosure requirements as a result of FASB Accounting Standards Update No. 2010-20, Disclosures About the Credit Quality

of Financing Receivables and the Allowance for Credit Losses.

10

Short-term trade receivables resulting from revenue transactions within the scope of ASC 605 and ASC 606 are excluded from these

disclosure requirements.

11

Under U.S. GAAP, an SEC filer is defined as follows:

An entity that is required to file or furnish its financial statements with either of the following:

- The Securities and Exchange Commission (SEC)

- With respect to an entity subject to Section 12(i) of the Securities Exchange Act of 1934, as amended, the appropriate agency under that Section.

Financial statements for other entities that are not otherwise SEC filers whose financial statements are included in a

submission by another SEC filer are not included within this definition.

11

ASC paragraph numbers have been omitted.

13

SC paragraph numbers have been omitted.