FASB Proposes Enhancements to Disclosures Related to Disaggregation of Income Statement Expenses (DISE)

Overview

On July 31, 2023, the FASB issued a proposed ASU1 that would enhance disclosures related to DISE for public business

entities (PBEs) to further disaggregate expenses in the footnotes to their

financial statements. However, the face of the income statement would not be

expected to change.

We encourage preparers and practitioners to comment on the

proposed ASU; comments are due by October 30, 2023. In addition, the FASB will

host a public roundtable on December 13, 2023, to discuss the proposal,

including the effective date, which the proposal does not provide. In addition,

the FASB notes on its Web site that “[t]hose

interested in participating in the roundtable should submit a comment letter and

register for consideration.”

Background

There is currently limited guidance in ASC 220-102 on the presentation of expenses in the income statement. The objective of

the proposed ASU is to “address requests from investors for more detailed

information about the types of expenses (including employee compensation,

depreciation, and amortization) in commonly presented expense captions (such as

cost of sales, SG&A [selling, general, and administrative expenses], and

research and development).” The additional disclosure requirements would enable

investors to better understand the entity’s performance, evaluate the entity’s

prospects related to future cash flows, and “[c]ompare an entity’s performance

over time.” Under the proposed ASU, the existing provisions of ASC 205-10 and

ASC 225-10 would be expanded to require PBEs to further disaggregate expenses,

as discussed below.

Main Provisions of the Proposed ASU

The proposed ASU would require PBEs to disclose, in a tabular

format in the footnotes to the financial statements, disaggregated information

about specific categories underlying certain income statement expense line items

that are considered “relevant.” Unless the proposal states otherwise, the

disclosures would be required in both annual and interim financial statements.

Specifically, PBEs would have to disclose:

-

A disaggregation of any relevant expense caption presented on the face of the income statement that contains any of the following expense categories:

-

Depreciation, depletion, and amortization (DD&A) that are recognized as part of oil- and gas-producing activities.

The proposal indicates that a relevant expense caption would be an expense line item included on the face of the income statement that contains any of the expense categories listed in the five sub-bullets above. The application of this guidance may vary from industry to industry; not all income statement line items are expected to be identified as a relevant expense caption.For an illustration of the proposal’s disclosure requirements for entities with service operations, see Example 2 in Appendix A. -

A further disaggregation of inventory and manufacturing expenses (disclosed in accordance with the first sub-bullet above) into the following categories:

-

Purchases of inventory.

-

Employee compensation.

-

Depreciation.

-

Intangible asset amortization.

-

DD&A.

-

Changes in inventories.

-

Other costs capitalized to inventory and manufacturing expenses that are not included in the categories listed in the previous six sub-bullets.

-

Other adjustments and reconciling items.

This further disaggregation is expected to reconcile (1) costs capitalized to inventory during the period and (2) inventory and manufacturing expenses recognized during the period. The purpose is to explain the change in inventory, as presented in the balance sheet, in comparison to the costs recognized during the period. An entity would be required to provide a qualitative explanation for costs included in “other adjustments and reconciling items” as well as for “other costs capitalized to inventory and [other] manufacturing expenses” not included in the above categories. -

-

A qualitative description of the amounts remaining in each relevant expense caption that are not separately disaggregated. The detail of the “qualitative disclosures shall be commensurate with the significance of the amounts being described.”

-

Other expenses, gains, or losses that must be disclosed under existing GAAP, and that are recorded in a relevant expense caption, must be presented in the same tabular disclosure on an annual and, when applicable, interim basis. These amounts are:

-

Specified expenses, gains, and losses that should be presented under existing GAAP for each relevant expense category (e.g., impairment of long-lived assets).

-

Specified expenses, gains, and losses for each relevant expense category, only if those amounts are included entirely in one expense caption and not over multiple expense categories. For example, “if cost of sales was a relevant expense caption . . . and if amortization of costs to fulfill a contract with a customer was recognized entirely in cost of sales and not in multiple expense captions presented on the face of the income statement, then amortization of costs to fulfill a contract with a customer would be required to be included as a separate category.” However, in that same example, if the costs of fulfilling a contract were disaggregated across multiple expense captions, separate disaggregation would not be required.

-

-

A separate total of an entity’s selling expenses, which should be presented in a manner similar to research and development and advertising expenses.

-

The entity’s definitions of other manufacturing expenses and selling expenses. Although the FASB did not define selling expenses, such expenses should include only items that are presented as expenses in the income statement. This disclosure would only be required annually.

Considerations Related to DISE

Inventory and Manufacturing Expense

Inventory expense would include all inventory expenses “resulting from the

derecognition of inventory due to sale to customers, consumption in the

production of goods or services for such sale, or remeasurement (for

example, an impairment)” in accordance with ASC 330 or other

industry-specific guidance. Other manufacturing expenses “generally include,

but are not limited to, certain costs incurred as part of an entity’s

manufacturing activities that are not capitalizable (for example,

unallocated manufacturing overhead related to abnormally low

production).”

Purchases of Inventory

Purchases of inventory would include the amount of costs incurred in the

current reporting period to acquire raw materials and other externally

purchased inputs. These amounts can be capitalized to inventory or

expensed in manufacturing activities.

Changes in Inventories

A change in inventories would be calculated as the difference “between

the amount of inventory included on the balance sheet presented at the

end of the prior period and the amount of inventory included on the

balance sheet presented at the end of the current period.”

Connecting the Dots

Paragraph BC49 of the proposed ASU’s Background Information and

Basis for Conclusions states that “changes in inventories . . .

could include an adjustment to inventories resulting from an

impairment charge related to inventories capitalized in a prior

period.” Because the change in inventory presented on the

balance sheet year over year incorporates this adjustment, this

specific cost category reflects changes to the balance sheet

that would not otherwise be included in the expense categories

listed in the proposed ASU.

Other Adjustments and Reconciling Items and Other Costs Capitalized to Inventory and Other Manufacturing Expenses

Other adjustments and

reconciling items would include, if not disclosed separately, “other

amounts that are necessary to reconcile costs incurred to expenses

recognized.” As noted in the proposed ASU, these other adjustments would

include, if applicable:

-

“The amount of inventory derecognized during the period that does not meet the definition of inventory expense (for example, inventory derecognized as part of derecognition transactions within the scope of Subtopic 810-10 on consolidation).”

-

“The amount attributable to differences in the foreign currency exchange rates used to translate costs incurred, the beginning balance of inventory, and the ending balance of inventory in accordance with Subtopic 830-30 on foreign currency matters.”

For an illustration of the proposal’s disclosure

requirements for entities that have inventory and manufacturing

expenses, see Example

1 in Appendix A.

Employee Compensation

The definition of an

employee in the proposed ASU is aligned with that in ASC 718. Employee

compensation is intended to broadly capture the major types of consideration

granted or issued to employees in exchange for services. Disclosures about

employee compensation should include separate presentation of one-time

employee termination benefits, when applicable, within the tabular

disclosure.

An entity can elect to include in employee compensation “amounts attributable

to other transactions entered into for the benefit of employees (for

example, the provision of subsidized goods or services).” Such an election

would be applied consistently, and an entity should “disclose both that

those transactions have been included and a description of those

transactions.”

Connecting the Dots

The proposed ASU includes a practical expedient for

entities that present an expense caption for salaries and employee

benefits on the face of the income statement in compliance with SEC

Regulation S-X, Rule 9-04.3 This expedient, if elected, allows entities to continue using

a classification meeting that requirement, as opposed to

disaggregating employee compensation in accordance with the proposed

ASU.

For an illustration of the proposal’s disclosure

requirements for banks and bank holding entities, see Example 3 in Appendix

A.

Depreciation

Depreciation would be consistent with the amounts recorded

in accordance with ASC 360-10.

Intangible Asset Amortization

Intangible asset

amortization would be consistent with the amounts recorded in accordance

with ASC 350-30.

Amortization of a finance lease right-of-use asset and

amortization of leasehold improvements that are recorded under ASC 842-20

would be included in either depreciation or intangible asset amortization

expense categories.

Depreciation, Depletion, and Amortization

Although the Board acknowledges that DD&A is an industry-specific

expense, paragraph BC44 of the proposed ASU explains that “DD&A was

included as a separate required category because it represents a potentially

significant noncash expense that is recognized systematically, like

depreciation and intangible asset amortization.”

Thinking Ahead

The FASB is releasing the proposed ASU in response to the

continuing push from investors to obtain more information about an entity’s

financial performance, particularly the expenses an entity incurs in a given

period (e.g., to better understand an entity’s performance, assess an entity’s

future cash flows, and evaluate an entity’s performance over time and compare it

with that of other entities). We believe that an entity may need to modify its

existing financial reporting systems to compile and present the information

required under the proposed amendments.

As stated in paragraph BC121(f) of the proposed ASU, the Board chose not to

provide prescriptive guidance on how an entity classifies certain expenses. As a

result, entities may present certain expense amounts differently and there may

be a lack of comparability among entities, even those in similar industries.

Given the potential need to modify existing financial reporting

systems and the possibility of creating classification diversity given the lack

of prescriptive guidance on this topic, we encourage preparers and practitioners

to provide the FASB with feedback on the proposed amendments. See Appendix B for a list of the

proposed ASU’s specific questions for respondents.

Proposed Effective Date and Transition

Effective Date

The Board will determine the effective date of the guidance, and whether to

permit early adoption, after considering feedback on the proposed

amendments.

Transition

PBEs would be required to adopt the new guidance prospectively; however, an

optional retrospective application would also be provided.

Appendix A — Illustrative Examples

The examples below have been reproduced from the proposed ASU.

ASC 220-40

Example 1:

Disaggregation of Income Statement Expenses by an

Entity With Manufacturing and Service

Operations

55-4 This

Example illustrates one type of tabular format

disclosure that an entity could use to disclose

disaggregated expense amounts in accordance with

paragraphs 220-40-50-1 through 50-21. This Example also

illustrates the disclosure of selling expenses in

accordance with paragraphs 220-40-50-22 through

50-23.

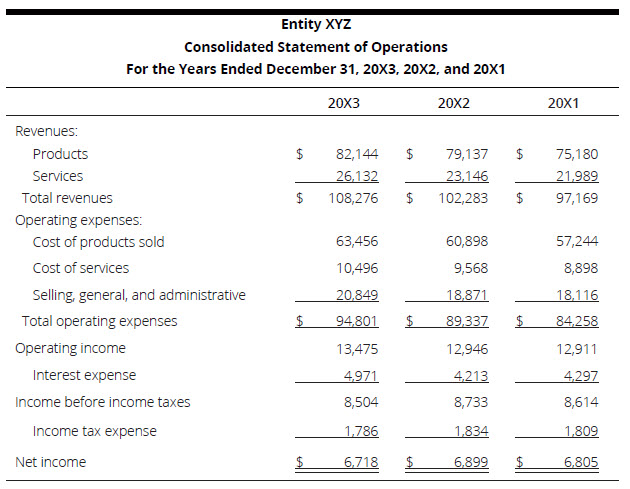

55-5 For the

year ended December 31, 20X3, Entity XYZ, which is a

manufacturer with significant service operations,

presents the following comparative statement of

operations.

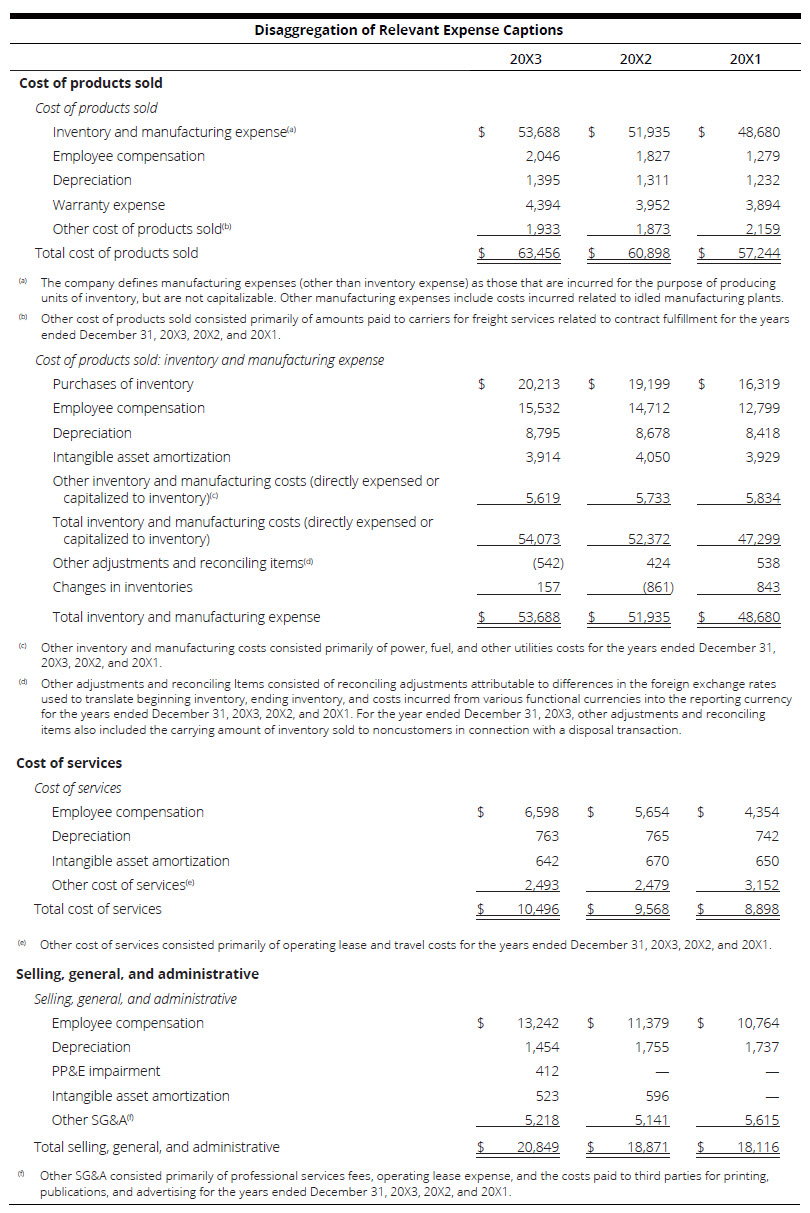

55-6 Entity XYZ

provides a disclosure that disaggregates the cost of

products sold, cost of services, and selling, general,

and administrative expense captions into the categories

listed in paragraph 220-40-50-4. Those expense captions

were identified as relevant expense captions because

those captions contain one or more of the expense

categories listed in paragraph 220-40-50-4. Even though

Entity XYZ presents other expense captions on the face

of its consolidated statement of operations, such as

interest expense and income tax expense, those expense

captions do not contain any of the expense categories

listed in paragraph 220-40-50-4 (including those

described in paragraph 220-40- 50-9), so those expense

captions do not need to be disaggregated.

55-7 In addition

to the categories listed in paragraph 220-40-50-4,

Entity XYZ further disaggregates inventory and

manufacturing expense in accordance with the

requirements in paragraphs 220-40-50-17 through 50-21.

In accordance with paragraph 220-40-50-21, Entity XYZ

qualitatively describes the nature of amounts included

in other costs capitalized to inventory and other

manufacturing expenses and other adjustments and

reconciling items.

55-8 Entity XYZ

also recognizes impairment of property, plant, and

equipment classified as held and used in selling,

general, and administrative expenses and, therefore,

includes this impairment as a separate category in the

tabular format disclosure in accordance with paragraph

220-40-50-12.

55-9 Entity XYZ

recognizes expenses associated with warranty accruals

entirely within cost of products sold and, therefore,

includes warranty expense as a separate category in

accordance with paragraph 220-40-50-13.

55-10 Entity XYZ

recognizes operating lease cost in both cost of services

and selling, general, and administrative expenses.

Therefore, in accordance with paragraph 220-40-50-13,

Entity XYZ is not required to separately disclose the

amounts of cost of services and selling, general, and

administrative expenses that are attributable to

operating lease cost. Instead, those expenses are

included in the amount for other items for each relevant

expense caption in accordance with paragraph

220-40-50-16.

55-11 Entity XYZ

provides the following disclosure.

55-12 In

addition to the tabular format disclosure illustrated in

paragraph 220-40-55-11, Entity XYZ also must disclose

its selling expenses and how it defines selling expenses

in accordance with paragraphs 220-40-50-22 through

50-23.

Selling

Expenses

During the years

ended December 31, 20X3, 20X2, and 20X1, selling

expenses were $13,425, $12,123, and $11,585,

respectively. The entity’s selling expenses include

those expenses related to marketing and promotional

activities and client relationship management.

Example 2:

Disaggregation of Income Statement Expenses by an

Entity With Service Operations

55-13 This

Example illustrates one type of tabular format

disclosure that an entity could use to disclose

disaggregated expense amounts in accordance with

paragraphs 220-40-50-1 through 50-16. This Example also

illustrates the disclosure of selling expenses in

accordance with paragraphs 220-40-50-22 through

50-23.

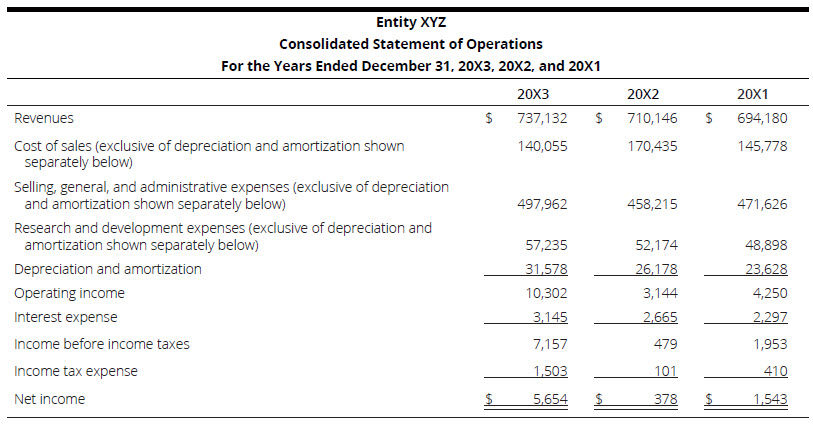

55-14 For the

year ended December 31, 20X3, Entity XYZ, which is a

services provider, presents the following comparative

statement of operations.

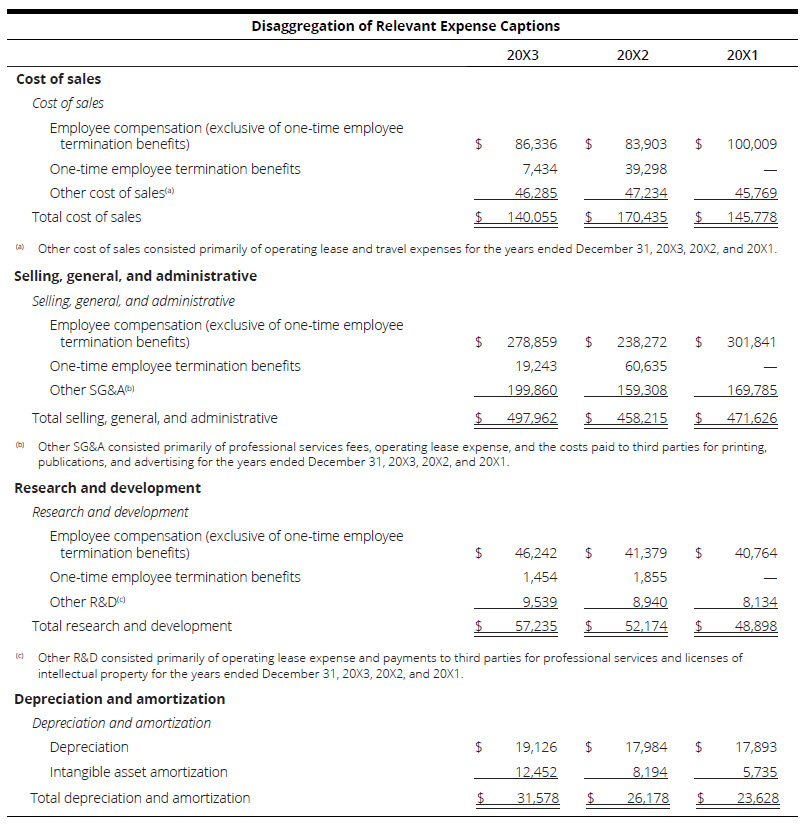

55-15 Entity XYZ

provides a disclosure that disaggregates the cost of

sales; selling, general, and administrative expenses;

research and development expenses; and depreciation and

amortization captions into the categories listed in

paragraph 220-40-50-4. Those expense captions were

identified as relevant expense captions because those

captions contain one or more of the expense categories

listed in paragraph 220-40-50-4. Even though Entity XYZ

presents other expense captions on the face of its

consolidated statement of operations, such as interest

expense and income tax expense, those expense captions

do not contain any of the expense categories listed in

paragraph 220-40-50-4 (including those described in

paragraph 220-40-50-9), so those expense captions do not

need to be disaggregated.

55-16 Entity XYZ

also recognizes one-time employee termination benefits

in cost of sales; selling, general, and administrative

expenses; and research and development expenses and,

therefore, includes this amount as a separate category

in the tabular format disclosure in accordance with

paragraph 220-40-50-12. Paragraph 220-40-50-12(e)

requires that an entity disclose the amount of each

major type of cost associated with an exit or disposal

activity (for example, one-time employee termination

benefits) that is recognized in each relevant expense

caption in the same tabular format in which the

disclosures required by paragraph 220-40-50-4 are

provided. Because one-time employee termination benefits

are a form of employee compensation, Entity XYZ

discloses that its employee compensation category

excludes one-time employee termination benefits because

one-time employee termination benefits are disclosed as

a separate category.

55-17 Entity XYZ

recognizes operating lease cost in both cost of sales

and selling, general, and administrative expenses.

Therefore, in accordance with paragraph 220-40-50-13,

Entity XYZ is not required to separately disclose the

amounts of cost of sales and selling, general, and

administrative expenses that are attributable to

operating lease cost. Instead, those expenses are

included in the amount for other items for each relevant

expense caption in accordance with paragraph

220-40-50-16.

55-18 Entity XYZ

provides the following disclosure.

55-19 In

addition to the tabular format disclosure illustrated in

paragraph 220-40-55-18, Entity XYZ also must disclose

its selling expenses and how it defines selling expenses

in accordance with paragraphs 220-40-50-22 through

50-23.

Selling

Expenses

During the years

ended December 31, 20X3, 20X2, and 20X1, selling

expenses were $224,536, $223,493, and $231,892,

respectively. The entity’s selling expenses include

those expenses related to advertising and certain

customer acquisition-related costs.

Example 3:

Disaggregation of Income Statement Expenses by a

Bank

55-20 This

Example illustrates one type of tabular format

disclosure that an entity could use to disclose

disaggregated expense amounts in accordance with

paragraphs 220-40-50-1 through 50-16. This Example also

illustrates the disclosure of selling expenses in

accordance with paragraphs 220-40-50-22 through

50-23.

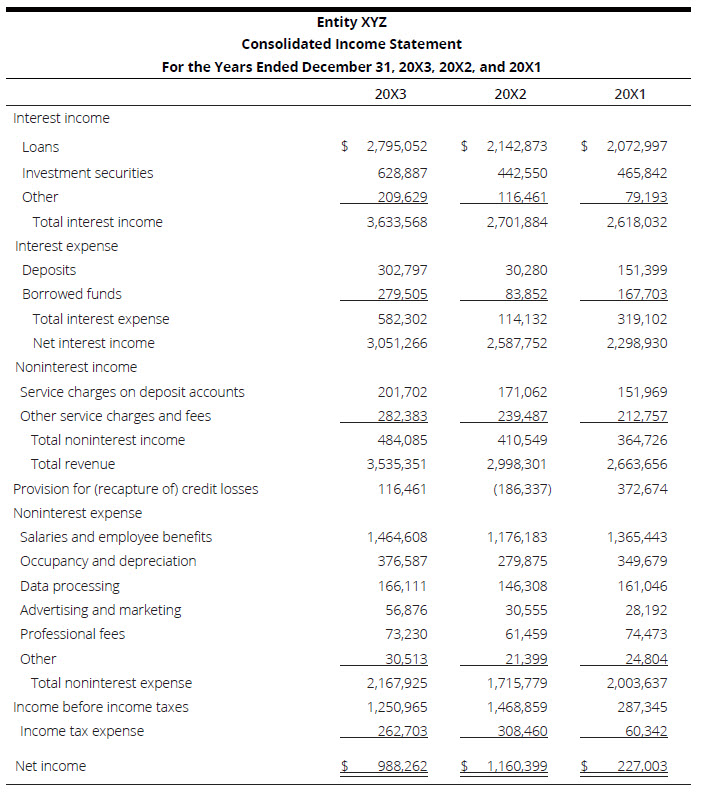

55-21 For the

year ended December 31, 20X3, Entity XYZ, which is a

bank, presents the following comparative income

statement.

55-22 Entity XYZ

provides a disclosure that disaggregates the occupancy

and depreciation expense and other expense captions into

the categories listed in paragraph 220-40-50-4. Those

expense captions were identified as relevant expense

captions because those captions contain one or more of

the expense categories listed in paragraph 220-40-50-4.

In this Example, even though Entity XYZ also presents

separate expense captions on the face of its

consolidated income statement for interest expense,

provision for credit losses, data processing,

advertising and marketing, professional fees, and income

tax expense, those expense captions do not contain any

of the expense categories listed in paragraph

220-40-50-4 (including those described in paragraph

220-40-50-9); therefore, those expense captions do not

need to be further disaggregated. Entity XYZ applies the

practical expedient for employee compensation described

in paragraph 220-40-50-11 and elects to not repeat the

amount presented on the face of the income statement in

the notes to financial statements.

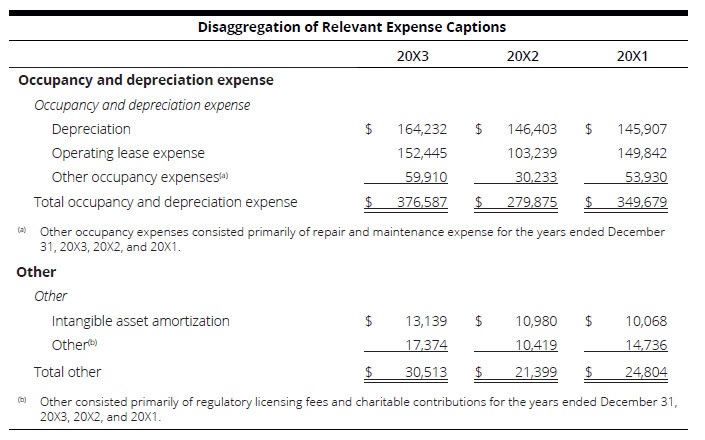

55-23 Entity XYZ

recognizes operating lease cost entirely within

occupancy and depreciation expense and, therefore,

includes operating lease cost as a separate category in

accordance with paragraph 220-40-50-13.

55-24 Entity XYZ

provides the following disclosure.

55-25 In

addition to the tabular format disclosure illustrated in

paragraph 220-40-55-24, Entity XYZ also must disclose

its selling expenses and how it defines selling expenses

in accordance with paragraphs 220-40-50-22 through

50-23.

Selling

Expenses

During the years

ended December 31, 20X3, 20X2, and 20X1, the company

defined selling expenses to be the same as its

advertising and marketing expenses, which are presented

on the face of its consolidated income statement. The

entity’s advertising and marketing expenses include

costs incurred for advertising, market research, and

business development.

Appendix B — Questions for Respondents

The proposed ASU includes the

following questions (reproduced from the proposal) for respondents to consider:

Expense Captions Subject to Disaggregation Requirements

Question 1: The amendments in this proposed Update would require that

a public business entity disclose disaggregated relevant expense

captions in the notes to financial statements. For preparers and

practitioners, are the proposed amendments for identifying relevant expense

captions operable? Please explain why or why not. If not, what changes would

you make?

Entities in Scope

Question 2: Should the proposed amendments apply to all public

business entities? Please explain why or why not.

Required Expense Categories

Question 3: The proposed amendments would require that an entity

disclose the amounts of (a) inventory and manufacturing expense, (b)

employee compensation, (c) depreciation, (d) intangible asset amortization,

and (e) DD&A that are included in each relevant expense caption. For

investors, would this proposed disclosure provide decision-useful

information? If so, how would that information be used? If not, what changes

would you make? Would any of the proposed categories not provide

decision-useful information? For example, are there categories that would be

more decision useful than the ones being proposed?

Question 4: For preparers, how does requiring disclosure of certain

categories of expenses included in relevant expense captions compare with

the operability and cost of requiring full disaggregation of income

statement expenses into natural categories (including the disclosure of

additional categories that would not be required by the proposed

amendments)? Are there other broadly applicable expense categories or

disaggregation approaches that would provide investors with more

decision-useful information, be less costly to provide, or both? Please

explain why or why not.

Question 5: For preparers and practitioners, is the proposed

definition of inventory expense operable? Please explain why or why

not. If not, what changes would you make?

Question 6: The proposed amendments would leverage the existing

definition of employee in Topic 718, Compensation — Stock

Compensation, and would add a definition of employee compensation.

For preparers and practitioners, are the proposed definitions of

employee and employee compensation operable, including for

entities with international operations, and would the proposed amendments

affect entities’ current application of the definition of employee in

Topic 718? Please explain. What changes, if any, would you make? For

preparers, would the proposed practical expedient that would allow certain

entities to disclose salaries and benefits in accordance with SEC Regulation

S-X Rule 9-04 be less costly to apply than applying the proposed definition

of employee compensation? For investors, would permitting the

application of that proposed practical expedient affect the decision

usefulness of the proposed disclosures? For all stakeholders, should the

definition of employee compensation include additional costs or

exclude any of the costs proposed? Please explain why or why not.

Question 7: For preparers and practitioners, would linking

depreciation and intangible asset amortization to existing disclosure

requirements in Subtopic 360-10, Property, Plant, and Equipment — Overall,

and Subtopic 350-30, Intangibles — Goodwill and Other — General Intangibles

Other Than Goodwill, be operable? Please explain why or why not.

Further Disaggregation of Inventory and Manufacturing Expense

Question 8: The proposed amendments would require further

disaggregation of inventory and manufacturing expense into the following

categories of costs incurred: (a) purchases of inventory, (b) employee

compensation, (c) depreciation, (d) intangible asset amortization, and (e)

DD&A. Those costs incurred categories would include costs that flow into

the balance sheet as inventory and also would include manufacturing costs

that are expensed directly. The costs incurred categories would not

represent costs flowing from inventory on the balance sheet to the income

statement when that inventory is sold or impaired. Residual costs incurred

would be included in an “other” category. For investors, would this proposed

disclosure provide decision-useful information? If so, how would that

information be used? If not, what changes would you make? Would any of the

proposed costs incurred categories not provide decision-useful information?

For example, are there categories that would be more decision useful than

the ones being proposed? Should the proposed requirement to further

disaggregate costs incurred that flow into the balance sheet as inventory be

expanded to include assets other than inventory? If so, which assets?

Question 9: The proposed amendments would require (a) that the costs

incurred that were capitalized to inventory during the current period be

combined with other manufacturing expenses and (b) that this total of

manufacturing-related expenses be disaggregated and disclosed separately

from nonmanufacturing expenses. For preparers, would this proposed

requirement be more or less costly to implement than if all such costs

(manufacturing and nonmanufacturing) were permitted to be combined? For

preparers and practitioners, is this proposed requirement operable? Please

explain why or why not.

Question 10: For preparers and practitioners, is the proposed

requirement to classify certain expenses as part of manufacturing activities

and disclose how an entity defines other manufacturing expenses (other

manufacturing expenses together with inventory expense constitute inventory

and manufacturing expenses) operable? Please explain why or why not. If not,

what changes would you make?

Question 11: For preparers and practitioners, are there any potential

practical expedients that would simplify or reduce the costs associated with

disaggregating inventory and manufacturing expense but would not

significantly diminish the decision usefulness of the information provided

to investors? For any potential practical expedients suggested, please

explain your reasoning.

Integration of Existing Disclosure Requirements

Question 12: The proposed amendments would require that an entity

include certain existing disclosures of expenses in the same tabular format

disclosure as the disclosures that would be required by the proposed

amendments. For investors, would including those expenses in the same

tabular format disclosure provide decision-useful information? Would this

improve your ability to locate relevant expense information in the notes to

financial statements? Please explain why or why not. For preparers and

practitioners, is this proposed requirement operable? Please explain why or

why not. For all stakeholders, are there other existing disclosures that are

not reflected in the proposed amendments and should be included in the lists

in paragraph 220-40-50-12, paragraph 220-40-50-13, or both? Please explain

why or why not.

Question 13: In addition to the disclosure requirements being

proposed, should other expenses that are currently disclosed in the

financial statements also be required to be integrated into the tabular

format disclosures (for example, other expenses that an entity voluntarily

discloses in total in the notes to financial statements)? Please explain why

or why not.

Qualitative Description of Other Items

Question 14: The proposed amendments would require that an entity

provide a qualitative description of any other items remaining in relevant

expense captions and any costs remaining in inventory and manufacturing

expense after the specific disaggregation requirements are applied. For

investors, would this proposed requirement provide decision-useful

information? If so, how would that information be used? If not, what changes

would you make? For preparers and practitioners, is this proposed

requirement operable? Please explain why or why not.

Selling Expenses

Question 15: The proposed amendments would require that an entity

disclose selling expenses and how it defines selling expenses. Should a

definition of selling expenses be developed, or should an entity be

required to determine what constitutes a selling expense? For investors,

would the proposed requirement provide decision-useful information? If so,

how would that information be used? If not, what changes would you make? For

preparers and practitioners, is the proposed requirement operable? Please

explain why or why not.

Interim Reporting

Question 16: The proposed amendments would require the disclosures on

both an annual basis and an interim basis. Do you agree with those proposed

amendments? Please explain why or why not.

Transition and Effective Date

Question 17: The proposed amendments would be applied on a prospective

basis with an option for an entity to apply the guidance retrospectively. Is

that proposed transition method operable? If not, why not and what

transition method would be more appropriate and why? Would the information

disclosed under the proposed transition method be decision useful? Please

explain why or why not.

Question 18: For preparers, would you expect to apply the proposed

amendments retrospectively, even if not required, to assist investors in

comparing performance to previous periods? Please explain why or why

not.

Question 19: Regarding the effective date, how much time would be

needed to implement the proposed amendments? Should early adoption be

permitted? Please explain why or why not.

Contacts

|

|

Tony Goncalves

Audit &

Assurance

Managing

Director

Deloitte &

Touche LLP

+1 202 879

4910

|

|

Kathleen Malone

Audit &

Assurance

Managing

Director

Deloitte &

Touche LLP

+1 203 761

3770

|

|

|

Christina Benvenuti

Audit &

Assurance

Senior Manager

Deloitte &

Touche LLP

+1 469 417

2349

|

Footnotes

1

FASB Proposed Accounting Standards Update (ASU),

Income Statement — Reporting Comprehensive Income — Expense

Disaggregation Disclosures (Subtopic 220-40): Disaggregation of

Income Statement Expenses.

2

For titles of FASB Accounting Standards

Codification (ASC) references, see Deloitte’s “Titles of Topics and

Subtopics in the FASB Accounting Standards

Codification.”

3

SEC Regulation S-X, Rule 9-04, Statements

of Comprehensive Income.