Summary of the September Meeting of the Emerging Issues Task Force

This EITF Snapshot summarizes the September 14, 2023, meeting of the Emerging

Issues Task Force (“EITF” or “Task Force”). Initial Task Force consensuses

(consensuses-for-exposure) are exposed for public comment upon ratification by the

Financial Accounting Standards Board (FASB). After the comment period, the Task

Force considers comments received and redeliberates the issues at a scheduled

meeting to reach a final consensus. Those final consensuses are then provided to the

FASB for final ratification and, ultimately, issuance as an Accounting Standards

Update (ASU).

The official EITF minutes will be posted to the Deloitte Accounting Research Tool

(DART) and to the FASB’s Web

site (note that the official EITF minutes may contain details

that differ from those in this publication). EITF meeting materials (released before the meeting and used to

frame the discussion) are also available on those sites.

Issue 23-A, “Induced Conversions of Convertible Debt Instruments”

Status: Consensus-for-exposure.

Affects: Entities that enter into arrangements involving convertible debt

instruments settled in accordance with conversion terms that differ from the

originally stated contractual conversion provisions.

Background: Convertible debt instruments are legal-form debt securities

that have features allowing conversion of the instruments into shares of the

issuer or affiliate entity at the option of the holder. The types of convertible debt instruments, as well as the features included in these instruments, can vary. For example, there are convertible debt instruments that can be (1) settled with a combination of shares and cash or (2) fully settled in cash. Historically, different types of convertible debt instruments have been summarized, for example, in SEC speeches and EITF Issue 90-19.1 The meeting memo describes these different types of instruments

as follows:

(a) Traditional Convertible Debt: Upon conversion, the

issuer must satisfy the obligation entirely in shares based

on a fixed number of shares into which the debt instrument is

convertible.

(b) Instrument C: Upon conversion, the issuer must

satisfy the accreted value of the obligation in cash and may

satisfy the conversion spread (the excess conversion value over the

accreted value) in either cash or stock.

(c) Instrument X: Upon conversion, the issuer may

settle the conversion value of the debt in shares, cash, or any

combination of shares and cash.

In August 2020, the FASB issued ASU 2020-06.2 Before the issuance of this ASU,3 entities that settled convertible debt instruments with cash conversion

features (CCFs) were required to (1) calculate an extinguishment gain or loss

equal to the difference between the carrying amount of the liability component

and the fair value of similar debt without a conversion feature and (2)

recognize the settlement of the conversion feature in equity.

ASU 2020-06 amends ASC 470-204 to allow entities to apply conversion accounting to settlements of

convertible debt instruments in accordance with their original contractual

conversion terms. However, entities would apply extinguishment accounting to any

convertible debt instruments settled whose terms differ (or are modified) from

the original contractual conversion terms. Under ASU 2020-06, entities are

required to (1) calculate an extinguishment gain or loss equal to the difference

between the carrying amount of the convertible debt instrument and the fair

value of the consideration issued on settlement and (2) recognize that

difference in gain or loss. As a result of the amendments made by ASU 2020-06,

entities can apply conversion accounting to convertible debt instruments settled

in either form (i.e., cash, shares, or a combination of both) as long as the

instrument is converted in accordance with its original contractual conversion

terms.

ASC 470-20 also includes a model for induced conversions, specifically for

“conversions of convertible debt to equity securities pursuant to terms that

reflect changes made by the debtor to the conversion privileges provided in the

terms of the debt at issuance.”5 Entities may, from time to time, offer a “sweetener” to entice convertible

debt instrument holders to settle their note before the end of the instrument’s

term. The inducements conversion model requires entities to recognize an expense

for the sweetener provided to induce the holder to convert. However, the entity

will not recognize a gain or loss for the shares issuable in accordance with the

original conversion terms of the convertible debt instruments, since conversion

accounting will apply.

Stakeholders have expressed concerns that when convertible debt instruments are

cash-settled in accordance with conversion terms that differ from the original

contractual conversion terms, it is difficult for stakeholders to determine

whether to apply induced conversion accounting or extinguishment accounting

after the adoption of ASU 2020-06. Although the definition of conversion

accounting, as amended by ASU 2020-06, remains indifferent regarding the form of

settlement, the induced conversion model still only applies to the conversion of

convertible debt instruments to “equity securities.” Accordingly, given the

amendments made by ASU 2020-06, stakeholders have asked the Board to provide

guidance on when either induced conversion accounting or extinguishment

accounting applies to settlements of convertible debt instruments whose terms

differ from the original contractual conversion terms.

At its April 26, 2023, meeting, the FASB decided to add a project

on induced conversions of convertible debt instruments to its technical agenda

and directed the EITF to address that project. Further, on June 15, 2023, the

EITF held an educational session to discuss preliminary approaches related to

this Issue. No formal votes were taken, and no decisions were made. For further

details about this meeting, see Deloitte’s June 2023 EITF Snapshot.

One of the questions the FASB staff asked the EITF to deliberate at its September

14, 2023, meeting was whether the preexisting contract approach or the

incremental fair value approach was preferable in the determination of whether

induced conversion accounting applies. Under the preexisting contract approach,

an inducement offer would need to preserve the form and amount of the

consideration under the original conversion terms for the entity to apply the

induced conversion accounting model. Under the incremental fair value approach,

the entity would assess the fair value of the inducement offer (regardless of

form), including any sweeteners offered, and compare it with the fair value

under the original conversion terms. If the fair value of the inducement offer

is greater, the entity would apply the induced conversion accounting model.

The FASB staff also asked the EITF to deliberate whether induced conversion

accounting should apply to convertible debt that is not currently convertible.

Convertible debt instruments may not be convertible because they have not

satisfied certain market contingencies (e.g., share price triggers) or nonmarket

contingencies (e.g., time-based restrictions).

Summary: At its September 14, 2023, meeting, the Task Force decided to

pursue amendments aligned with the preexisting contract approach, with the

following two clarifications:

-

Clarification 1 — When evaluating the inducement offer, issuers should determine, as of the offer acceptance date,6 whether the inducement offer would at least provide the cash, shares, or both, issuable under the original conversion terms.

-

Clarification 2 — If a modification (that did not result in extinguishment accounting) has occurred in the year (12 months) before the offer acceptance date, the form and amount specified in the “original conversion privileges” would refer to the terms that existed one year before the offer acceptance date.

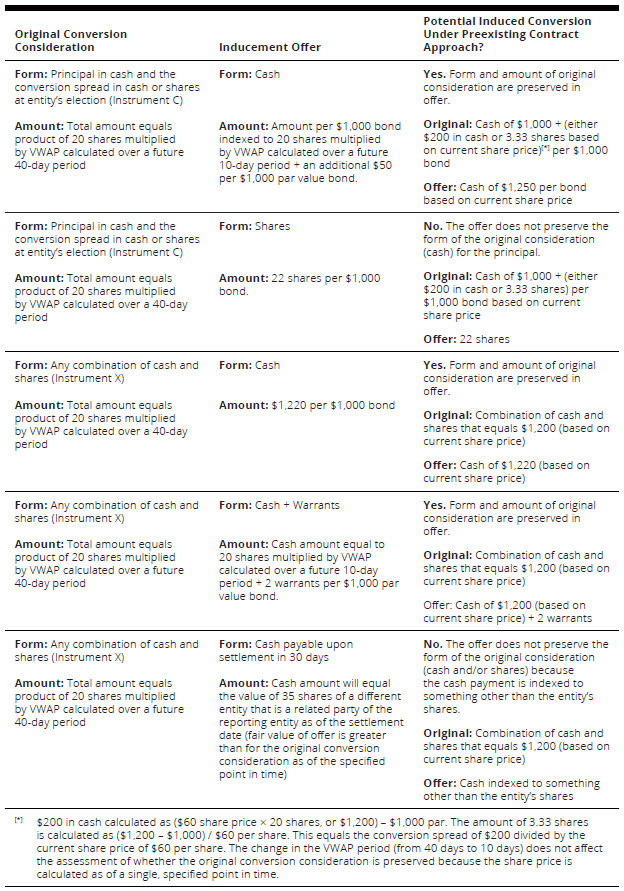

To demonstrate the application of the preexisting contract approach, the

following examples have been reprinted from the meeting memo for the September meeting:

All examples assume the fair value of an entity’s share of common stock

is $60 as of the [offer acceptance date7] and assume a par value of $1,000 for the convertible debt.

In addition, the Task Force decided that induced conversion

accounting may apply to all convertible debt instruments, including conversions

of convertible debt instruments that are not currently convertible, that are

within the scope of ASC 470-20 and have a substantive conversion feature8 as of the time of issuance.

Effective Date and Transition: The Task

Force tentatively decided that the guidance in EITF Issue 23-A would be applied

prospectively to convertible debt instruments settled after the effective date.

An entity would be permitted, but not required, to apply the guidance

retrospectively to convertible debt instruments only settled after the adoption

of ASU 2020-06. Transition disclosures would be required for the period of

adoption, including the nature of and reason for the change in accounting

principle.

The Task Force will discuss the effective date at a future meeting after

considering stakeholder feedback on the proposed amendments.

Next Steps: The FASB staff expects to draft a proposed ASU related to this

Issue and present it to the Board for ratification in October 2023.

Administrative Matters

The next EITF decision-making meeting is tentatively scheduled for November 30,

2023. However, on the basis of the timeline for Issue No. 23-A discussed at the

September meeting, it is unlikely that this Issue will be discussed in November.

Further details about the timeline, including the comment-letter period for the

proposed ASU, should be available at the November meeting. The EITF will most

likely reconvene in early 2024 to discuss the comment letters received on the

proposal.

Footnotes

1

EITF Issue No. 90-19, “Convertible Bonds With Issuer Option to Settle for

Cash Upon Conversion.”

2

FASB Accounting Standards Update No. 2020-06, Accounting for

Convertible Instruments and Contracts in an Entity’s Own

Equity.

3

For public business entities that are not smaller reporting companies,

ASU 2020-06 is effective for fiscal years beginning after December 15,

2021, and interim periods within those fiscal years. For all other

entities, the ASU is effective for fiscal years beginning after December

15, 2023, and interim periods within those fiscal years. The guidance

may be early adopted for fiscal years beginning after December 15, 2020,

and interim periods within those fiscal years. For convertible

instruments that include a down-round feature, entities may early adopt

the amendments that apply to down-round features if they have not yet

adopted the amendments in ASU 2017-11, Earnings per Share (Topic

260); Distinguishing Liabilities From Equity (Topic 480);

Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain

Financial Instruments With Down Round Features, (Part II)

Replacement of the Indefinite Deferral for Mandatorily Redeemable

Financial Instruments of Certain Nonpublic Entities and Certain

Mandatorily Redeemable Noncontrolling Interests With a Scope

Exception.

4

FASB Accounting Standards Codification (ASC) Subtopic 470-20, Debt:

Debt With Conversion and Other Options.

5

Quoted text is from ASC 470-20-40-13.

6

The Task Force voted to select the offer acceptance date as

of which the assessment is performed, in accordance with

Issue 2, “Assessment Date.”

7

The date at which the assessment is performed was addressed by

the Task Force in Issue 2, “Assessment Date,” as described in

more detail in the meeting memo.

8

ASC 470-20-40-7 defines a substantive conversion feature as a “conversion

feature [that] is at least reasonably possible of being exercised in the

future. If the conversion price of an instrument at issuance is

extremely high so that conversion of the instrument is not deemed at

least reasonably possible as of its issuance date, then the conversion

feature would not be considered substantive.”