No Free Passes: How the New Current Expected Credit Loss Standard Affects Nonbanks

Background of the CECL Model

In June 2016, the FASB issued ASU 2016-13,1 which amends the Board’s guidance on the

impairment of financial instruments. The ASU adds to U.S. GAAP an impairment model (known

as the current expected credit loss (CECL) model) that is based on expected losses rather than

incurred losses. Under the new guidance, an entity recognizes as an allowance its estimate of

lifetime expected credit losses, which the FASB believes will result in more timely recognition

of such losses. The ASU is also intended to reduce the complexity of U.S. GAAP by decreasing

the number of credit impairment models that entities use to account for debt instruments.

Further, the ASU makes targeted changes to the impairment model for available-for-sale debt

securities. The guidance in ASU 2016-13 is codified in ASC 326.2

Connecting the Dots

In late 2015, the FASB established a transition resource group (TRG) for credit losses.

The credit losses TRG does not issue guidance but provides feedback to the FASB

on potential implementation issues. On the basis of the TRG’s discussions, the FASB

determines whether it needs to take further action (e.g., by clarifying or issuing

additional guidance). The TRG met three times from 2016 to 2018 and discussed

approximately 15 issues. The FASB subsequently issued three ASUs (2018-19,3

2019-04,1 and 2019-055) to amend and clarify the guidance in ASU 2016-13,

including the effective date and transition provisions.

The new CECL standard6 is effective for public companies that meet the U.S. GAAP definition

of an SEC filer for annual reporting periods beginning after December 15, 2019, and interim

periods therein. For public companies that are not SEC filers, the guidance is effective for

annual reporting periods beginning after December 15, 2020, and interim periods therein.

For private companies, the guidance is effective for annual reporting periods beginning after

December 15, 2021, and interim periods therein. For most debt instruments, entities must use

a modified retrospective approach to adopt the new CECL standard (including the guidance

in the ASUs subsequently issued by the FASB), meaning entities will record a cumulative-effect

adjustment to the statement of financial position as of the beginning of the first reporting

period in which the guidance is effective.7

Once effective, the new guidance will significantly change the accounting for credit

impairment. Although the new CECL standard has a greater impact on banks, most nonbanks

have financial instruments or other assets (e.g., trade receivables, contract assets, lease

receivables, financial guarantees, loans and loan commitments, and held-to-maturity

(HTM) debt securities) that are subject to the CECL model. While banks and other financial

institutions (e.g., credit unions and certain asset portfolio companies) have been closely

following standard-setting activities related to the new CECL standard, are actively engaged in

the discussions with the FASB and the TRG, and are far along in the implementation process,

many nonbanks may not have started evaluating the effect of the CECL model. Because the

effective date of the new standard is quickly approaching, nonbanks should (1) focus on

identifying which financial instruments and other assets are subject to the CECL model and

(2) evaluate whether it is necessary to make changes to existing credit impairment models to

comply with the new standard.

Key Considerations for Nonbanks Under the CECL Model

The discussion below summarizes the types of financial instruments and other assets that

nonbanks (e.g., commercial entities) may have that are subject to the CECL model.2 These

are in addition to long-term financing arrangements that are economically similar to lending

activities of banks and other financial institutions that are offered by some commercial entities

for products or services sold to clients. Depending on the nature and extent of an entity’s

financial instruments (and other affected assets), the CECL model described in the sections

below may be more or less relevant to an entity.

Trade Receivables

Receivables that result from revenue transactions under ASC 606 are subject to the CECL

model. ASC 606-10-25-1(e) requires an entity to perform an evaluation at contract inception

to determine whether it is “probable that the entity will collect substantially all of the

consideration to which it will be entitled” for goods or services transferred to the customer

(the “collectibility threshold”). This evaluation takes into account “the customer’s ability and

intention to pay [the] consideration when it is due.” The purpose of the assessment is to

determine whether there is a substantive transaction between the entity and the customer,

which is a necessary condition for the contract to be accounted for under ASC 606. Although

the collectibility threshold contemplates a customer’s credit risk associated with trade

receivables that will be recorded under a contract with a customer, the entity’s conclusion

that the collectibility threshold is reached does not imply that all receivables that result from

the revenue transaction are collectible. That is, once a receivable is recorded, it is unlikely that

the entity will be able to assert that there are no expected losses on the trade receivable. The

entity must calculate its expected credit losses to determine whether it should recognize an

impairment loss related to the trade receivable and, if so, in what amount. The likely result is

that the entity will record an allowance for expected credit losses on trade receivables earlier

under a CECL model than it would under existing accounting.

ASU 2016-13 includes an illustrative example in ASC 326-20-55-38 through 55-40 (see

the appendix for a reproduction of the example) on the application of the CECL model to

trade receivables by using a provision matrix. The ASU’s example highlights that an entity’s

application of the CECL model to trade receivables through the use of a provision matrix may

not differ significantly from the entity’s current methods for determining the allowance for

doubtful accounts. However, the example illustrates that when the entity uses a provision

matrix to estimate credit losses on trade receivables, it would be required to do the following

when moving to an expected loss model:

- Under the CECL model, the entity would be required to consider whether expected credit losses should be recognized for trade receivables that are considered “current” (i.e., not past due).

- When using historical loss rates in a provision matrix, the entity would be required to consider whether and, if so, how the historical loss rates differ from what is currently expected over the life of the trade receivables (on the basis of current conditions and reasonable and supportable forecasts about the future).

Although the CECL model requires entities to perform a different evaluation for trade

receivables, we generally do not expect that most entities will see a significant change in the

impairment losses recognized on trade receivables. While this will usually be true for entities

with short-term trade receivables, entities with longer-term trade receivables (e.g., those with

due dates that extend beyond one year) may experience more of a change under the CECL

model. In these cases, entities will need to consider whether a reasonable and supportable

forecast exists to incorporate into the estimated impairment loss.

Credit Risk Versus Variable Consideration

ASC 606-10-45-4 states that “[u]pon initial recognition of a receivable from a contract with

a customer, any difference between the measurement of the receivable in accordance with

Subtopic 326-20 and the corresponding amount of revenue recognized shall be presented

as a credit loss expense.” However, the amount of revenue recognized in a contact with a

customer can change as a result of changes in the transaction price. This is because the

amount of consideration an entity expects to be entitled to for promised goods or services

that have transferred to a customer may vary depending on the occurrence or nonoccurrence

of future events, including potential price concessions that an entity might grant. That is, an

entity may accept (and is expected to accept) less than the contractually stated amount of

consideration in exchange for promised goods or services. Concessions might be granted as a result of product obsolescence but might also be granted because of credit risk assumed by

the vendor in the transaction. Consider the example below reproduced from ASC 606.

ASC 606-10

Example 3 — Implicit Price Concession

55-102 An entity, a hospital, provides medical services to an uninsured patient in the emergency

room. The entity has not previously provided medical services to this patient but is required by law

to provide medical services to all emergency room patients. Because of the patient’s condition upon

arrival at the hospital, the entity provides the services immediately and, therefore, before the entity

can determine whether the patient is committed to perform its obligations under the contract in

exchange for the medical services provided. Consequently, the contract does not meet the criteria

in paragraph 606-10-25-1, and in accordance with paragraph 606-10-25-6, the entity will continue to

assess its conclusion based on updated facts and circumstances.

55-103 After providing services, the entity obtains additional information about the patient including

a review of the services provided, standard rates for such services, and the patient’s ability and

intention to pay the entity for the services provided. During the review, the entity notes its standard

rate for the services provided in the emergency room is $10,000. The entity also reviews the

patient’s information and to be consistent with its policies designates the patient to a customer class

based on the entity’s assessment of the patient’s ability and intention to pay. The entity determines

that the services provided are not charity care based on the entity’s internal policy and the patient’s

income level. In addition, the patient does not qualify for governmental subsidies.

55-104 Before reassessing whether the criteria in paragraph 606-10-25-1 have been met, the entity

considers paragraphs 606-10-32-2 and 606-10-32-7(b). Although the standard rate for the services

is $10,000 (which may be the amount invoiced to the patient), the entity expects to accept a lower

amount of consideration in exchange for the services. Accordingly, the entity concludes that the

transaction price is not $10,000 and, therefore, the promised consideration is variable. The entity

reviews its historical cash collections from this customer class and other relevant information about

the patient. The entity estimates the variable consideration and determines that it expects to be

entitled to $1,000.

55-105 In accordance with paragraph 606-10-25-1(e), the entity evaluates the patient’s ability and

intention to pay (that is, the credit risk of the patient). On the basis of its collection history from

patients in this customer class, the entity concludes it is probable that the entity will collect $1,000

(which is the estimate of variable consideration). In addition, on the basis of an assessment of the

contract terms and other facts and circumstances, the entity concludes that the other criteria in

paragraph 606-10-25-1 also are met. Consequently, the entity accounts for the contract with the

patient in accordance with the guidance in this Topic.

As noted in the example above, the entity believes that it is probable that it will collect $1,000

from the patient, which is less than the contractual price of $10,000. Accordingly, the entity

records a receivable of $1,000 when it renders services to the patient. Under ASC 326-20,

the entity is required to evaluate financial assets on a collective (i.e., pool) basis when assets

share similar risk characteristics. Therefore, in this example the entity would need to consider

its portfolio of similar trade receivables to determine whether it would have to record

an additional allowance. This is because although it is probable that the entity will collect

$1,000, it is not certain that the entity will collect $1,000 from all similarly situated patients.

Accordingly, the entity would likely need to record an additional allowance for further expected

credit losses on the basis of the expected collections across its portfolio of trade receivables.

Entities will need to use significant judgment in determining whether recorded receivables

are not collectible because the entities have provided an implicit price concession or as a

result of incremental credit risk beyond what was contemplated when the transaction price

was established. This is particularly true of entities in highly regulated industries, such as

health care and consumer energy, which may be required by law to provide certain goods

and services to their customers regardless of the customers’ ability to pay. Therefore, entities will need to evaluate all of the relevant facts and circumstances of their arrangements to

determine whether they have provided implicit price concessions or whether the anticipated

receipt of less than the total contractual consideration represents additional credit risk that

may require them to record additional credit losses upon the adoption of ASC 326-20. These

credit losses are measured on the basis of the losses that would be expected to be incurred

over the entire contractual term (i.e., the period over which the receivables recorded will be

collected).

Vintage Disclosures

Although there are similarities between the disclosure requirements under existing

impairment guidance and the new CECL standard, a significant addition to the disclosure

requirements is the stipulation in ASC 326-20-50-6 that a public business entity must present

“the amortized cost basis within each credit quality indicator by year of origination (that is,

vintage year)” (the “vintage disclosure”). ASC 326-20-50-9 provides an exception whereby

entities do not need to provide the vintage disclosure for trade receivables that are due in

one year or less. Because many trade receivables are due within one year or less, entities

with trade receivables will likely not have to comply with the vintage disclosure requirement.

However, entities with trade receivables whose due dates extend beyond one year will be

subject to the vintage disclosure requirement. These entities should consider the availability of

data that will enable them to comply with that requirement.

Contract Assets

Contract assets arise when an entity recognizes revenue, but the entity’s right to consideration

is conditioned on something other than only the passage of time (e.g., the satisfaction of

additional performance obligations in the contract). Contract assets are commonly referred

to as unbilled receivables. ASC 606-10-45-3 states that an entity should assess whether a

contract asset is impaired in accordance with ASC 310 (before the adoption of the new CECL

standard) or ASC 326-20 (after the adoption of the new CECL standard). Because collection

of unbilled receivables is conditioned on something other than just the passage of time (e.g.,

future performance under the contract), contract assets may take longer to recover than

trade receivables. Consequently, an entity that has contract asset balances may be more

exposed to expected credit losses for recorded amounts than an entity that has only shortterm

trade receivables. Further, an entity’s policy for determining incurred losses on trade

receivables (e.g., a matrix approach) might not contemplate contract assets. Entities may need

to implement additional policies and procedures to capture contract assets in their allowance

for expected credit losses.

The following example illustrates how a contract asset is recorded under ASC 606 and is

recovered over a contract period:

Example

On January 1, 20X1, Entity X enters into an arrangement to license its software to Customer Y for

five years with coterminous postcontract support (PCS). In exchange for the license to X’s software

and PCS, Y agrees to pay X an annual fee of $500, invoiced at the beginning of each year (total

transaction price of $2,500) with payments due within 60 days of invoice (i.e., 60 days after the first

of each year).

Entity X concludes the following about its arrangement with Y:

- The promises to deliver the software license and PCS represent distinct performance obligations. Using a stand-alone selling price allocation method, X allocates 60 percent of the total transaction price to the software license and 40 percent to the PCS.

- Entity X’s software is a form of functional intellectual property, and therefore, the license grants Y the right to use its intellectual property for the five-year contract term. As a result, X satisfies its performance obligation to transfer the software license at a point in time (i.e., contract inception).

- Entity X’s promise to provide PCS is satisfied over time by using a time-based measure of progress (i.e., ratably over the five-year contract term).

- Entity X concludes that the contract does not contain a significant financing component.9

In accordance with ASC 606, X recognizes revenue as follows:10

Each year, X provides PCS under the contract and bills the customer $500. Of that $500, $300

effectively is applied against the contract asset recorded when the license was transferred to the

customer, while the other $200 relates to PCS provided each year. Consequently, the contract asset

would have a four-year contractual term (the period over which X will collect the contract asset).

Upon the adoption of the new CECL standard, X will need to estimate losses that will be incurred

over the contractual term (i.e., four years) when determining the loss allowance that needs to be

recorded on the contract asset.

Although ASC 606 states that an entity should apply the CECL model to contract assets,

the term “contract asset” is not mentioned in ASC 326-20. While ASC 606-10-45-3 clearly

notes that contract assets are subject to the measurement guidance in ASC 326 and that a

credit loss of a contract asset “shall be measured, presented, and disclosed in accordance

with Subtopic 326-20,” questions have arisen about which disclosure requirements apply

to contract assets. Some believe that ASC 606 indicates that a contract asset is a financial

asset measured at amortized cost that is within the scope of ASC 326-20 for subsequent

measurement and disclosure, even though this is not explicitly stated in ASC 326-20.11

Alternatively, others believe that a contract asset does not meet the definition of a financial

asset12 measured at amortized cost because the entity does not have the unconditional right

to receive cash until the contract asset becomes a trade receivable (i.e., once the entity has

the right to collect the consideration from the customer).

Connecting the Dots

Contract assets may not be converted to receivables and subsequently collected

for more than one year. Consequently, if considered to be within the scope of

ASC 326-20, contract assets may not meet the short-term exception for certain

disclosures. Specifically, questions remain about (1) whether contract assets are

subject to the vintage disclosure requirements in ASC 326-20-50-4 and 50-5 and

(2) if so, how an entity should determine the vintage year (i.e., the year of origination)

for the contract asset. We believe that the differing views on these issues have

merits and recommend that entities that have material contract asset balances

that will be outstanding (i.e., not collected) for more than one year consult with an

adviser.

Lease Receivables

In addition to trade receivables, receivables that result from sales-type or direct financing

leases under ASC 842 are subject to the CECL model. The FASB changed how an entity should

evaluate whether an impairment loss exists for sales-type or direct financing lease receivables

upon adopting ASC 842.13

Under ASC 840, a lessor was required to assess the net investment in the lease for

impairments by using two different impairment models:

- The lease receivable was evaluated under the impairment guidance in ASC 310.

- The unguaranteed residual asset was evaluated under the impairment guidance in ASC 360.

ASC 842 did not carry forward the dual impairment model. Rather, ASC 842 requires an

entity to apply a single impairment model under ASC 310 (before adopting the new CECL

standard) or ASC 326-20 (upon adopting the new CECL standard) to recognize and measure

an impairment loss on sales-type or direct financing lease receivables. In the Background

Information and Basis for Conclusions of ASU 2016-02,14 the FASB explained its rationale for

shifting to a single impairment model for sales-type and direct financing leases. The Board

observed that although the unguaranteed residual asset does not meet the definition of a

financial asset, the net investment in a lease primarily consists of a financial lease receivable

(i.e., the unguaranteed residual asset is often insignificant). Therefore, the FASB believed that

applying a single impairment model to the entire net investment in the lease would reduce

complexity and cost for entities.

Under the CECL model, a lessor should consider the cash flows it expects to derive from the

underlying asset during the remaining lease term as well as the cash flows it expects to derive

from the underlying asset at the end of the lease term (i.e., cash flows expected to be derived

from the residual asset) when evaluating whether the net investment in the lease is impaired.

Connecting the Dots

In November 2018, the FASB issued ASU 2018-19 to clarify certain aspects of the

CECL model. Specifically, ASU 2018-19 states that operating lease receivables are

within the scope of ASC 842 rather than ASC 326. That is, an entity would apply

ASC 842 rather than ASC 326-20 to account for instances in which it concludes that

collection of all amounts due under an operating lease is not probable.

Loan Commitments

Off-balance-sheet arrangements such as commitments to extend credit and standby letters

of credit that are not considered derivatives under ASC 815 are subject to credit risk and are

therefore within the scope of the CECL model. Loan commitments consist of both a funded

and unfunded portion. The funded portion is the amount of cash actually provided to the

borrower (i.e., the amount of the loan commitment that the borrower has drawn upon).

Accordingly, ASC 326-20 requires an entity’s method for determining the estimate of expected

credit losses on the funded portion of a loan commitment to be similar to its method for

determining the estimate of expected credit losses for other loans.

The unfunded portion is the amount of the loan commitment that has not yet been borrowed;

however, because a borrower could request the remaining funds at any point during the

term of the loan commitment, the debtor must have enough cash on hand to satisfy the

unfunded portion of the loan commitment. For the unfunded portion of a loan commitment,

an entity must estimate expected credit losses over the full contractual period over which

the entity is exposed to credit risk under an unconditional present legal obligation to extend

credit. Such an estimate takes into account both the likelihood that the funding will occur and

the expected credit losses on commitments to be funded. The entity’s estimate of expected

credit losses on unfunded loan commitments (e.g., credit card receivables) will depend on

(1) whether the entity has the unconditional ability to cancel the commitment to extend credit

and, if so, (2) the time it takes for the cancellation to become effective.

If the entity has the unconditional ability to cancel the unfunded portion of a loan

commitment, the entity would not be required to estimate expected credit losses on that

portion, even if the entity has historically never exercised its cancellation right. Rather, the

entity would need to evaluate only whether an impairment loss exists for the funded portion

of the loan commitment.

Financial Guarantees

Financial guarantees that are not accounted for as insurance and not considered derivatives

under ASC 815 are within the scope of the CECL model. Nonbanks may have various forms

of financial guarantees (e.g., a guarantee to pay an equity method investee’s debt if the

equity method investee does not pay). Guarantees are initially accounted for under ASC 460,

which requires the guarantor to recognize a liability for the fair value of the guarantee. The

guarantee liability is derecognized when or as the guarantor is released from its obligation.

Further, entities should apply the guidance in ASC 326-20 to evaluate whether an impairment

loss exists on the guarantee and, if so, the amount of the impairment loss that should be

recognized.

Held-to-Maturity Debt Securities

Nonbanks may also have investments in HTM debt securities, which are measured at

amortized cost and therefore subject to the CECL model. In accordance with existing U.S.

GAAP in ASC 320-10, an entity applies an other-than-temporary impairment (OTTI) model to

evaluate whether an impairment loss should be recognized for HTM debt securities. Under

the OTTI model, the entity recognizes an impairment loss if (1) the fair value of the HTM debt

security is less than its cost and (2) the entity does not expect to recover the entire cost basis

of the HTM debt security (i.e., the impairment loss is not temporary). After adopting the new

CECL standard, the entity will no longer apply an OTTI model to HTM debt securities. Under

the CECL model, any expected credit losses should be recognized as an allowance, which

represents an adjustment to the amortized cost basis of the HTM debt security (i.e., the

amortized cost basis represents the net amount of the cost of the HTM debt security less the

allowance). That is, the CECL model does not distinguish between temporary and OTTI losses.

Connecting the Dots

Under existing U.S. GAAP, available-for-sale (AFS) debt securities are subject to

the OTTI model in ASC 320-10. That is, an entity’s evaluation of whether it should

recognize an impairment loss is similar for HTM debt securities and AFS debt

securities under existing U.S. GAAP.15 However, the CECL model does not apply to

AFS debt securities but does apply to HTM debt securities. Therefore, upon adoption

of the new standard, entities with both HTM and AFS debt securities will be required

to apply two credit loss models to determine whether an impairment loss exists for

these types of debt securities.

Available-for-Sale Debt Securities

For investments in AFS debt securities, ASU 2016-13 did not revise (1) step 1 of the existing

OTTI model (i.e., an “investment is impaired if the fair value of the investment is less than

its cost”) or (2) the requirement under ASC 320 for an entity to recognize in net income the

impairment amount only related to credit and to recognize in other comprehensive income

the noncredit impairment amount. However, the ASU made certain targeted changes to the

impairment model for AFS debt securities to eliminate the concept of “other than temporary”

from that model. Accordingly, the ASU states that an entity:

- Must use an allowance approach (vs. permanently writing down the security’s cost basis).

- Must limit the allowance to the amount by which the security’s fair value is less than its amortized cost basis.

- May not consider the length of time fair value has been less than amortized cost.

- May not consider recoveries in fair value after the balance sheet date when assessing whether a credit loss exists.

Because the ASU requires an entity to use an allowance approach for certain AFS debt

securities when recognizing credit losses (as opposed to a permanent write-down of the AFS

security’s cost basis), the entity would reverse credit losses through current-period earnings

on an AFS debt security if the estimate of expected credit losses decreases in a subsequent

period. In addition, the ASU moves the guidance applicable to AFS debt securities from ASC

320 to ASC 326-30.

Getting Started

With the deadline quickly approaching for public companies to adopt the new CECL standard,

nonbanks should not wait to begin assessing the impacts of the new standard on their

portfolio of assets subject to the CECL model, including financial assets and contract assets.

We believe that entities should consider taking the following steps to adopt the new standard:

- Identify the portfolio of assets that are subject to the CECL model.

- Understand the current impairment models for assets that are subject to the CECL model.

- Identify gaps between (1) current state accounting and existing impairment models and (2) future state accounting and impairment models that will be required by the new CECL standard.

- Develop and implement a strategy with key activities and milestones. Key activities include, but are not limited to, the following:

- Documenting accounting policies.

- Developing and implementing impairment models.

- Designing, implementing, and testing internal controls.

- Drafting illustrative disclosures required by ASC 326-20, as well as required disclosures under SAB Topic 11.M (SAB 74).16

- Plan for post-implementation support by developing a sustainable process that can be used to refine impairment models, support ongoing data collection, and comply with other requirements.

Entities should consider the mandated disclosures under SAB 74, which requires SEC

registrants to disclose quantitative and qualitative information about the expected impact of

adopting new accounting standards. The SEC staff expects entities to disclose the status of

their efforts to implement the new CECL standard in periods before they adopt it. If entities

do not know, or cannot reasonably estimate, the expected financial statement impact of

adopting the new CECL standard, they should disclose that fact. In such situations, the SEC

staff has indicated that it expects a qualitative description of the effect of adopting the new

accounting policy, including a comparison of the new accounting policy with an entity’s current

accounting. The entity should also disclose (1) the status of its process to implement the new

CECL standard and (2) significant implementation matters yet to be addressed.

In addition, entities should continue to follow developments that result from the TRG’s

discussions and the FASB’s standard-setting activity.

For more information on the steps entities should take to ensure they are ready to implement

the CECL model, see Deloitte’s CECL Standard Implementation: What’s at Stake for Companies

in the Consumer Industry? and CECL 2019: Finish Strong, With Confidence.

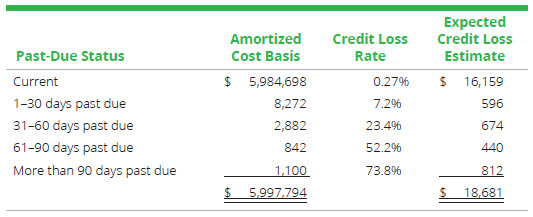

Appendix — Application of the CECL Model to Trade Receivables

The example below, which is reproduced from ASC 326-20-55-38 through 55-40 (Example 5), illustrates how an entity

would apply the proposed guidance to trade receivables that result from revenue transactions under ASC 606 by using a

provision matrix.17

Entity E manufactures and sells products to a broad range of customers, primarily retail stores. Customers typically are provided

with payment terms of 90 days with a 2 percent discount if payments are received within 60 days. Entity E has tracked historical

loss information for its trade receivables and compiled the following historical credit loss percentages:

- 0.3 percent for receivables that are current

- 8 percent for receivables that are 1–30 days past due

- 26 percent for receivables that are 31–60 days past due

- 58 percent for receivables that are 61–90 days past due

- 82 percent for receivables that are more than 90 days past due.

Entity E believes that this historical loss information is a reasonable base on which to determine expected credit losses for trade

receivables held at the reporting date because the composition of the trade receivables at the reporting date is consistent with

that used in developing the historical credit-loss percentages (that is, the similar risk characteristics of its customers and its

lending practices have not changed significantly over time). However, Entity E has determined that the current and reasonable

and supportable forecasted economic conditions have improved as compared with the economic conditions included in the

historical information. Specifically, Entity E has observed that unemployment has decreased as of the current reporting date, and

Entity E expects there will be an additional decrease in unemployment over the next year. To adjust the historical loss rates to

reflect the effects of those differences in current conditions and forecasted changes, Entity E estimates the loss rate to decrease

by approximately 10 percent in each age bucket. Entity E developed this estimate based on its knowledge of past experience for

which there were similar improvements in the economy.

At the reporting date, Entity E develops the following aging schedule to estimate expected credit losses.

Footnotes

1

FASB Accounting Standards Update (ASU) No. 2016-13, Measurement of Credit Losses on Financial Instruments.

2

For titles of FASB Accounting Standards Codification (ASC) references, see Deloitte’s “Titles of Topics and Subtopics in the FASB

Accounting Standards Codification.”

3

FASB Accounting Standards Update No. 2018-19, Codification Improvements to Topic 326, Financial Instruments — Credit Losses.

1

FASB Accounting Standards Update No. 2019-04, Codification Improvements to Topic 326, Financial Instruments — Credit Losses,

Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments.

5

FASB Accounting Standards Update No. 2019-05, Financial Instruments — Credit Losses (Topic 326): Targeted Transition Relief.

6

“New CECL standard” refers to ASU 2016-13 and the three subsequent ASUs issued by the FASB (see footnotes 3, 4, and 5). For

entities that have not yet adopted the guidance in ASU 2016-13, the effective date for the subsequently issued ASUs is the same as

the effective date of ASU 2016-13. However, for entities that have already adopted the guidance in ASU 2016-13, the effective date

for the subsequently issued ASUs is for fiscal years beginning after December 15, 2019, including interim periods within those fiscal

years.

7

Specific transition guidance applies for the following financial instruments: (1) other-than-temporarily impaired debt securities,

(2) purchased credit-deteriorated assets, and (3) certain beneficial interests within the scope of ASC 325-40.

2

For a comprehensive discussion of the CECL model as well as the targeted changes to the credit impairment model for AFS debt

securities, see Deloitte’s June 17, 2016, Heads Up.

9

Significant judgment may need to be applied to determine whether the transaction price should be adjusted to account for a

significant financing component. See ASC 606-10-32-15 through 32-20.

10

For simplicity, only the journal entry at contract inception is provided.

11

See ASC 326-20-15-2.

12

The ASC master glossary defines a financial asset as “[c]ash, evidence of an ownership interest in an entity, or a contract that

conveys to one entity a right to do either of the following:

- Receive cash or another financial instrument from a second entity

- Exchange other financial instruments on potentially favorable terms with the second entity.”

13

Note that the effective date of the new leasing standard in ASC 842 precedes the effective date of the new CECL standard in ASC

326. Unless an entity early adopts the new CECL standard, it will adopt the new leasing standard before adopting the new CECL

standard.

14

FASB Accounting Standards Update No. 2016-02, Leases (Topic 842).

15

Differences between the evaluation of whether an OTTI exists for HTM debt securities and AFS debt securities are primarily related

to the requirement for an investor to evaluate whether it intends to sell (or will be required to sell) the AFS debt security.

16

SEC Staff Accounting Bulletin Topic 11.M, “Disclosure of the Impact That Recently Issued Accounting Standards Will Have on the

Financial Statements of the Registrant When Adopted in a Future Period” (SAB 74).

17

ASC paragraph numbers have been omitted.